Nothing discussed/written should be considered as investment advice. Please do your own research or speak to a financial advisor before putting a dime of your money into these crazy markets. In other words, if you buy something I bought, you deserve to lose your money.

The only reason why I am making my portfolio public because it provides accountability to me. Some or all the analysis I provide could be from the top of my head and should not be considered accurate.

My investing goal is simple; to try to manage risk while being fully invested without market timing. Howard Marks said it best, “even though we can’t predict, we can prepare.”

All my references to the Market are only for the US Market.

Performance

For the year my stock portfolio was up 25% compared to 29% for the S&P 500. If I included the selling of stock to fund the I Bond purchases my total returns were 30%.

| Year | Me | SPY | Difference |

| 2020 | 21.30% | 18.37% | 2.93% |

| 2021 | 25.21% | 28.79% | -3.58% |

Where We Are Now

Below is an excerpt from “Buffett: The Making of an American Capitalist” by Roger Lowenstein.

Oddly, when Warren Buffett graduated, in 1951, both Graham and his father advised him not to go into stocks. Each had the post-Depression mentality of fearing a second visitation. Graham pointed out that the Dow had traded below 200 at some point in every year, save for the present one. Why not postpone going to Wall Street until after the next crash, his heroes counseled, and meanwhile get a safe job with someone like Procter & Gamble?

It was awful advice — violating Graham’s tenet of not trying to forecast markets. The Dow, in fact, never went under 200 again. “I had about ten thousand bucks,” Buffett noted later. “If I’d taken their advice I’d probably still have about ten thousand bucks.”

As of December 30 the US stock market had a CAPE ratio of 40 and the Buffett Indicator is about 215%. These metrics indicate the American stock market is overpriced and possibly in bubble territory. When I see indicators showing a massive overvaluation my tendency is to go to cash and wait for the market to collapse.

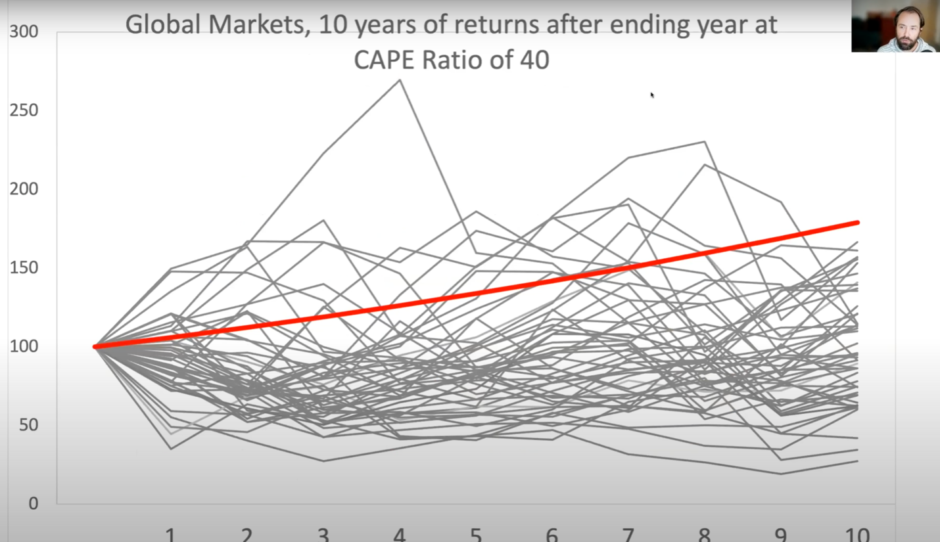

Meb Faber posted (image below) a chart of the returns of countries that traded at CAPE’s of over 40 (source: YouTube). The sample size is about 50 and the average real returns is 0%. The red line is a real 6% return per year and none of the countries, over ten years, were able to provide more than 6% return per year. Lastly, you’ll notice that most of the carnage (drawdowns) occur within the first three years.

It’s very possible the market is not overpriced. Fisher Investments argues that on a forward earnings basis the market isn’t a egregiously expensive. Bill Miller also doesn’t think the US stock market is that overpriced as a whole.

I used Buffett’s quote to remind myself that the stock market is one of the best ways to compound money and you shouldn’t be afraid of drawdowns. However, Buffett also said, “The less prudence with which others conduct their affairs, the greater the prudence with which we should conduct our own affairs.” Its that dichotomy of opinion that’s been weighing on me since my Q3 update.

One of Howard Marks’ mantra’s is to move forward, but with caution. I’m the type of person who focuses much more on what could go wrong than what could go right.

Based on my personal situation I’ve decided to slightly de-risk. Specifically, I took some gains off the table and allocated those funds to safer investments. Primarily, maxing out my contribution to I Bonds in January 2022. (I already maxed out my contribution in 2021.)

The primary reason to de-risk is I will have smaller amounts of additional capital coming in each month. The most important thing I can do is have enough capital to ensure I do not have to sell my investments in the event of a drawdown.

It’s extremely difficult right now to de-risk but it’s important to make these types of decisions when things are well and when I do not have emotional duress. A better way to say is by John Wooden, “When you fail to prepare, you’re preparing to fail.”

A little more detail about my personal finances; I have a home mortgage and about 65% of my monthly salary (including the HOA) goes towards the mortgage. With my cash balance, I Bonds and physical precious metals I have enough liquidity to pay my expenses for at least a year if I lost my job tomorrow. It could be argued I am being overly cautious but that’s why everyone should manage their finances based on their own risk threshold.

Lastly, having more cash means I can play fantasy baseball for higher buy-ins. In the past three seasons (2018-19 and 2021) I’ve played in six leagues and I’ve cashed in five of them (including winning three). At this point I believe my performance is not due to luck and warrants palying for more money.

I Bonds

(I first wrote about I Bonds in my 2021 Q2 Update.)

A friend of mine stayed with me over the Thanksgiving holiday. She got her Masters degree 12-16 months ago in physical therapy. She currently works at her local hospital, makes good money and will likely have the ability to be employed and make good money for as long she wants to work. She is very intelligent. If we took an IQ test her score would be at least ten points higher than mine.

To me, she represents the typical white collar worker in regards to the understanding of how compounding works in the stock market. Specifically, she understands the teachings of John Bogle.

- That the base rate of the stock market over the past 80-90 years is roughly a 9-10% return per year.

- The best way to accumulate to achieve that rate of return is via low-cost index funds.

Lastly, she has no interest in learning any more about investing, which is totally cool and understandable.

Since most of my free time is spent reading and thinking about finance some of our discussions were about finance.

I talked a lot about why she should look into putting money into inflation-linked savings bonds (I-bonds) because they’re currently yielding 7.12% and with inflation probably continuing to run hot for the next few months the interest rate will probably remain high when the interest rate changes in April 2022.

I told her I was pretty confident the I Bond would probably outperform a market cap weighted S&P 500 index fund in 2022 and possibly for the next five years. She asked, “why?” and I told her based on the two indicators I mentioned previously and at the current valuation the S&P 500 will maybe nominally yield 2-4% with dividends reinvested.

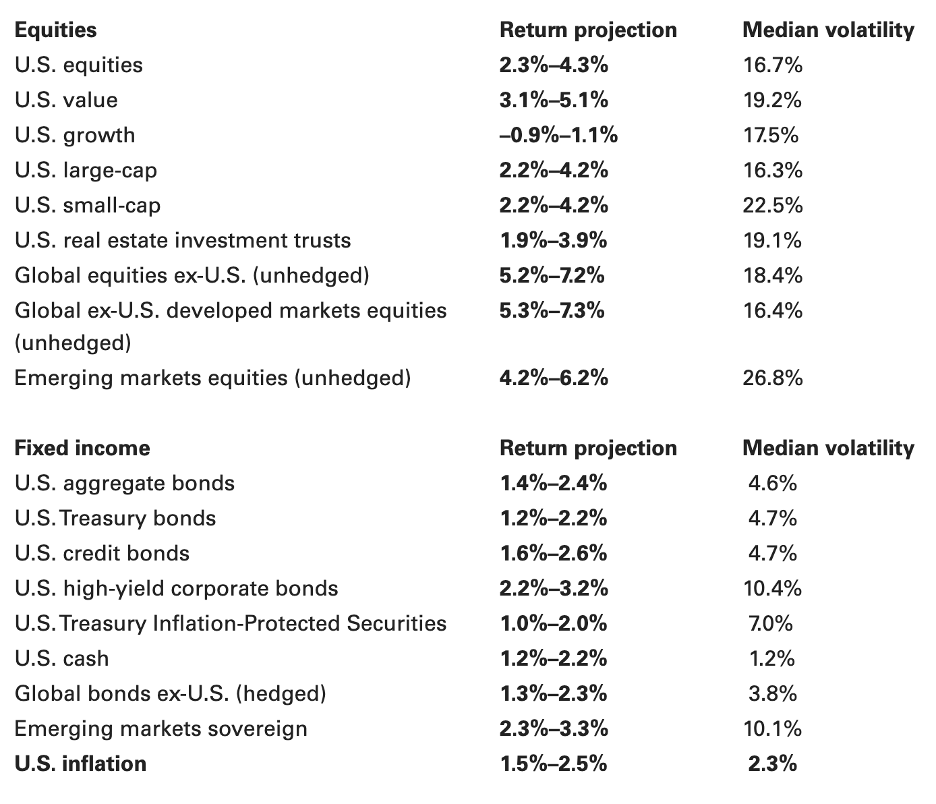

A week after Thanksgiving Vanguard came out with their forecasted 10 year nominal returns by asset class (below):

I think my friend’s hesitation to I Bonds was why should she buy a 7% yielding asset when the base rate of the US stock market is 9-10%?

Since March 2020 the market has essentially doubled and the economy has rebounded. What if she buys I Bonds and the market is up 18% next year? (“The S&P 500 has gained 5% to 10% just six times in the past 94 years. The S&P 500 goes up about two-thirds of the time, and when it does, it gains an average of 18%. It has declined about one-third of the time, with an average drop of 14%.” Source: Barrons.com)

I totally get it. No one likes to be wrong especially with hard earned savings…especially when you’re not in the minutiae of investing. I don’t know anything about cars and one of my friends knows everything about cars. If I had car trouble he could A) diagnose the problem quickly and B) would say it’s a quick fix; all I’d have to do is X. To him it’s a quick fix but for me it probably means I’m spending all of my Saturday trying to fix it. I imagine that’s how she feels when we were talking about finance.

The last thing I will say about I Bonds is if you qualify for a tax refund you can take payments in I Bonds. According to the IRS you can get up to $5k of your refund via I Bonds. To recap, you can buy up to $10k per year from the US Treasury and an additional $5k via your tax refund.

Portfolio Activity

I sold all my shares Alibaba and Tencent at a 11% profit to have additional money to pay for my 2022 contributions to my IRA and I Bonds. In my Q3 update I wasn’t expecting to sell those shares but as I mentioned above, my personal finances changed. I also sold all my Fairfax shares to buy more PLx Pharma and Micron.

Thoughts On Holdings

Briefly on Micron, about 70% of their revenue comes from DRAM. Micron now makes the industry’s smallest feature sized DRAM node which significantly outperforms the competition and at a lower cost. Micron also produced the first 176 layer NAND (this segment is about 25% of revenue) which is the most advanced NAND mode on the market. The biggest headwind for the company is China. When I first made an investment two years I thought it would be at least a decade before China had its own factories online. It appears China, with the help stealing intellectual property from Micron, may have their factories in a few years.

In mid-December the board of Equity Commonwealth approved an additional $150 million dollar buyback. With this additional $150 million authorized, the company now has $170.5 million available for future share repurchases, including $20.5 million remaining under its prior authorization that expires on June 30, 2022. As an owner of the business I am completely on-board with the board’s actions. The company has about $3 billion in cash and their market cap is $3.15 billion. This is a heads I win and I don’t lose very much if it comes tails.

In regards to Kinross Gold’s bid to buy Great Bear Resources, I’m okay with the deal. According to the press release 80% of the property hasn’t been explored yet and Great Bear has not released a resource estimate yet. This indicates there’s a bit of gamble in this purchase but I liked the management prior to the transaction and I’m going back their play.

In regards to The Acquirers ETF ($ZIG) it was recently announced the fund is not going to be shorting stocks in the future. With a current expense ratio of 0.89% I am going to reevaluate this holding in Q1 of 2022. Value is extremely cheap and according to the recent blog (it’s more of a chart than a blog) from Cliff Asness this may be the best time to be invested in Value so perhaps the expense ratio could be offset by the funds outperformance. In my 401k I’m 100% invested in a small cap value fund and the expense is 1.07% (it’s up 23.4% for 2021, which is a little less than the S&P 500) but since my investment options were limited and in my opinion, the value fund provided the most upside I choose the fund despite the costs. However, in my personal account I have vastly more options so the 0.89% expense may be too high.

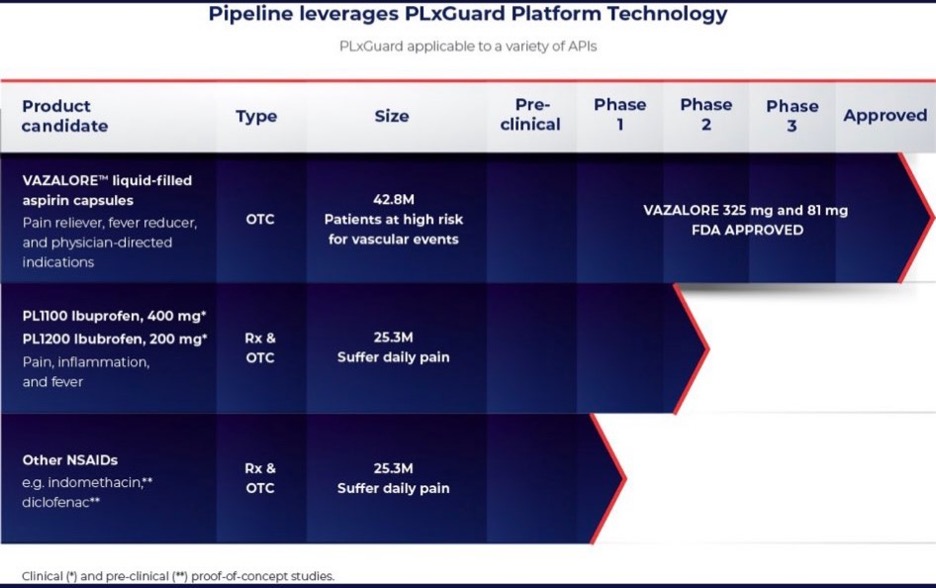

In regards to PLx Pharma, I haven’t sold any shares and I bought a little more. It’s been a strange two months for the growth stocks I track. Starting in mid-October companies like PLx Pharma and The Joint started their drawdowns from their all-time highs. I started buying the stock at $8 and I saw it rocket up to $20, never selling a share. In hindsight it would have made sense to sell a portion but for all I knew the stock could have been the next Gamestop or AMC. PLx Pharma has a market cap $219.2 million with $82.5 million in cash. The question is would I pay $133.7 million for an FDA approved medication that is substantially better than all the competitiors? Also, I’m getting 58 patents and the company is in clinical trials for different medications with the same delivery system as Vazalore. One headwind is pricing power. If we get a recession and/or inflation stays hot, will people want to pay more for the drug? In my mind, it’s an easy yes but the actions of people confound me every day.

“Having lost ground during the pandemic, military stocks are now at their cheapest valuations in eight years” (source: WSJ.com). I bought a basket of military stocks last year and I think these companies are extremely cheap especially since the government, no matter whose in power, continues to increase military spending. “The House voted Tuesday to approve a $778 billion defense-policy and budget bill that authorizes $25 billion more in defense spending than requested by President Biden” (source: WSJ.com).

Precious metals

I don’t have a predicitive or precise model on how to value any precious metal. The method I use is I divide the price of 1 ounce by the average home value. In other words, how many ounces of gold does it take to buy a house? Using that metic I can see how valuable a precious metal has become.

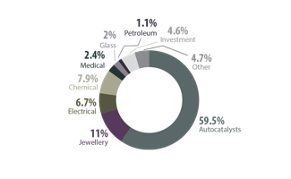

Homes are similar to precious metals in that, unless someone does Airbnb, homes don’t provide cash flow but they appreciate in value. Gold and silver are fairly valued. However, platinum is extremely cheap; in fact it’s the cheapest its ever been. One caveat, I only have 53 years of data compared to 70 years for gold and silver.

Even though platinum appears to be cheap there are some headwinds for the metal. Specifically the world is still over supplyed with platinum and its primary use is with autocatalysts in diesel engines (image source: Government of Canada). I’m not buying platinum at today’s price because I’m not smart enough to meaningfully know if platinum is really cheap at $980. However, if it gets below $800 I’ll be a buyer because at that price I think that’s a big enough margin of safety that doesn’t require expert knowledge to make a profit.

The table below is a breakdown of my portfolio on January 1, 2022. What you see below where my entire net worth, excluding my home, is allocated. Lastly, my 401k is 100% invested in a Small Cap Value Fund.

| Company | % |

| MU | 11.7% |

| BRK.B | 10.3% |

| PLXP | 6.6% |

| MKL | 6.2% |

| BAC | 5.7% |

| SCHW | 3.5% |

| MO | 3.2% |

| MMP | 3.0% |

| GVAL | 2.1% |

| AIMFF | 2.0% |

| EPD | 2.0% |

| ZIG | 1.8% |

| GLRE | 1.7% |

| HII | 1.7% |

| EQC | 1.6% |

| NEM | 1.5% |

| OGZPY | 1.5% |

| GD | 1.5% |

| NOC | 1.4% |

| KGC | 1.1% |

| ERUS | 1.0% |

| LMT | 1.0% |

| XOM | 0.9% |

| SMIT | 0.9% |

| CVX | 0.8% |

| PREKF | 0.5% |

| FNDC | 0.4% |

| EPOL | 0.4% |

| EWUS | 0.1% |

| LAND | 0.0% |

| FPI | 0.0% |

| ACGBY | 0.0% |

| Gold | 2.8% |

| Platinum | 0.7% |

| Farmland | 3.7% |

| I Bonds | 6.0% |

| Cash | 6.1% |

| 401k | 4.6% |

Below is a breakdown by category:

| Bonds | 6.0% |

| Cash | 6.1% |

| Conglomerate | 10.3% |

| Defense | 5.6% |

| Financials | 9.2% |

| Insurance | 6.2% |

| International | 4.1% |

| Manager | 6.5% |

| Oil/Gas | 8.6% |

| Other | 3.2% |

| Pharma | 6.6% |

| Precious Metals | 6.1% |

| Real Estate | 5.3% |

| Semiconductor | 11.7% |

| Small Value | 4.6% |