Nothing discussed/written should be considered as investment advice. Please do your own research or speak to a financial advisor before putting a dime of your money into these crazy markets. In other words, if you buy something I bought, you deserve to lose your money.

Even though no one will read this I am making my portfolio public because it provides accountability. Some or all the analysis I provide could be from the top of my head and should not be considered 100% accurate.

For the second quarter I’m up 17.9% while SPY, a S&P 500 index fund, is up 5.9%. I honestly don’t care what my performance is quarter to quarter because there is nothing intelligent that one can say about short periods like three months.

All my references to the Market are only for the US Market.

My goal is simple; to try to manage risk while being fully invested without market timing. Howard Marks said it best, “even though we can’t predict, we can prepare.”

*this letter may not be as well written as previous letters; that is because I was in the middle of a move.

Portfolio Update

For the year-to-date I am up 27.3% while the S&P 500 is up 15.3%. My outperformance this quarter was due to value stocks continuing to do well and PLx Pharma Inc. increasing 62%. I have been adding to the position and it is now my third largest holding on a cost basis.

Where We Are Now

Inflation has been running hot but the bond market doesn’t care. In fact, US bond yields have been decreasing in June. On March 29, 2021 the 10-year Treasury closed at 1.721%. At the close on June 30 it closed at 1.485%. Adam Robinson says when the Market is doing something and you’re confused by what’s happening the onus is on you to update your view of the world.

A lot of legendary investors say the bond market is the most intelligent of all the equity markets. I know the Federal Reserve is buying a lot of bonds, but they can’t be buying all the bonds and thus, causing the interest rates to decrease.

So, what is the bond market telling us? My best guess is they think inflation is indeed transitory and/or GDP growth is going to slow down a lot; possible as soon as the end of 2021. If growth slows then US stocks are going to take a dive especially the little to no revenue growth names.

However, it’s possible low bond yields are near term bullish for stocks. “The S&P 500 closed at a new all-time high this past week (June 11, 2021), while the 10-year yield closed at its lowest level in three months—only the 18th time since 1968 that the index closed at a three-year high while bonds traded at a near-term low. On previous occasions, the S&P 500 was higher six months later 82% of the time, with a median gain of 6.9%. Growth stocks gained 5.4% and were higher 71% of the time, while value stocks gained 11.2% and were higher 88% of the time—giving value the upper hand.” (Source: Barrons.com)

Lower interest rates are good for stocks but I keep coming back to:

- Can the Federal Reserve keep buying assets forever?

- No. When will they stop? No one knows especially since they’re the ones with the money printer.

- Stocks can’t go up forever.

- In the fabulous book Bull! By Maggie Mahar there were professional investors who called a top in 1995 and they had to wait five years before deploying their capital. Am I capable of selling and going to cash?

- As a world, especially in the developed parts, growth in GDP is going to be difficult because of demographics.

- If you combine a low growth world with a ton of debt and already all-time low interest rates things don’t look good. In that world having cash maybe more preferable.

- If I sell stocks and go to cash I am trading in an asset like Bank of America that will give me a shareholder yield of about 7-10% for an asset that will lose its value over time. On the flip side, having cash is like having a huge call option.

“The periodic liquidation of parts of a portfolio has a cathartic effect. For the many investors who prefer to remain fully invested at all times, it is easy to become complacent, sinking or swimming with current holdings. ‘Dead wood’ can accumulate and be neglected while losses build. By contrast, when the securities in a portfolio frequently turn into cash, the investor is constantly challenged to put that cash to work, seeking out the best values available.” (Source: Margin of Safety by Seth Klarman)

I’m very uneasy about the forward returns for US market. I’ve seen forecasts as low as negative five percent to maybe four percent after inflation with dividends reinvested.

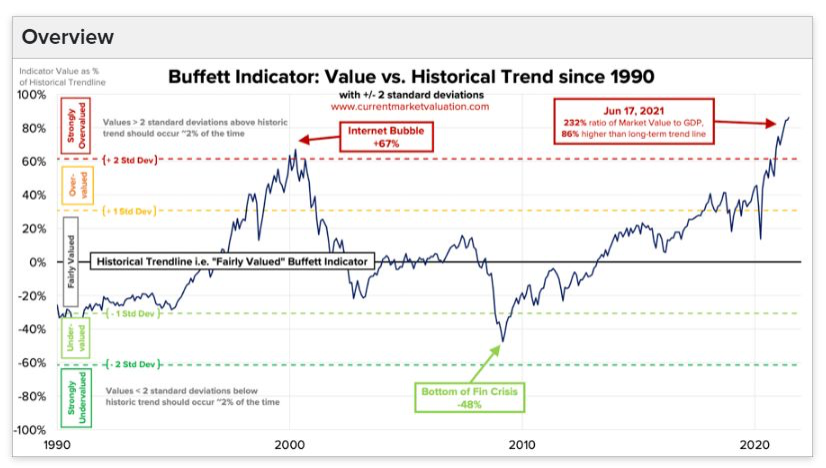

As of now I’m a fully invested bear. When I see the Buffet Indicator and Cape Ratio at screaming high levels it’s extremely difficult to not have any cash lying around because I wouldn’t be surprised if at any moment US stocks get a correction larger than 10%.

Most importantly, do not confuse a bull market for intelligence.

Inflation

In my Q1 update I cited the increase in bank loans as a catalyst for inflation. Well, according to the latest data loan volume is almost back to levels seen in January 2020. I have no feel for what will happen with inflation; I can see either scenario playing out and I won’t be surprised at either outcome.

Bonds

Since I’m a homeowner again it’s important to build up my rainy day fund. Most people need 3-12 months of costs saved. How many months is the best? It’s a personal choice. Having a lot of cash with interest rates at 0.5% and 2-5% inflation is an awful prospect.

I read the articles from the Rational Walk and Jason Zweig about I Bonds. They currently yield 3.54% until Nov. 1, 2021. The interest rate resets every six months and interest is earned on the bond every month.

Quoting from Mr. Zweig’s article, “What if interest rates or inflation head lower? Yes, the yield can decline. But, unlike with Treasury inflation-protected securities, or TIPS, the yield on I bonds can never go below zero.”

You can buy up to $10,000 a year. I Bonds are also exempt from state and local income tax but they are subject to federal income tax. If you hold for five years or more you get the full amount of interest. If you sell them between 1-5 years you lose the previous three months of interest. You have to hold the bonds for at least 12 months.

Inflation for May was five percent. Buying a bond that only yields 3.54% doesn’t make sense. However, a rainy day fund is emergency cash so in my opinion you should consider what interest rates can you get for your cash. I can’t find anything larger than 3.54%.

Most importantly (for me), the real interest rate on my home is 2.70%. If I can put money into I Bonds at 3.54% I should make a slight profit on the spread (between the two rates) even after paying Federal taxes.

In other words, I believe I Bonds are fantastic for my personal situation because after five years I could cash out my I Bonds and pay my mortgage and make a slight profit with virtually zero risk.

Portfolio Activity

I added a starter position to PrairieSky Royalty ($PREKF) in my IRA. I had to buy it in my IRA because of the way the dividends are taxed. They’re a passive foreign investment company (“PFIC”), which is a fancy way of saying you’ll get taxed a ton. Since Micron was a big part of the IRA I had to trim it; I didn’t want to pay exhorbant amount of taxes. (I am still very bullish on Micron.)

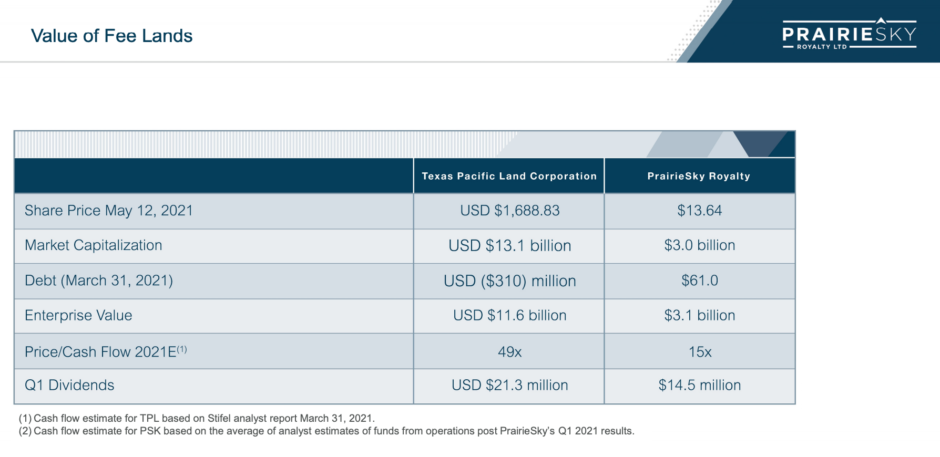

PrairieSky is a pure-play royalty company, generating royalty revenues from oil and natural gas across 16 million acres in Western Canada. I came across them because the business model was very similar to Texas Pacific Land Corporation ($TPL).

PrairieSky has a large buyback (they bought 4% of shares last year), virtually no debt and is selling at a much lower multiple than $TPL (image below and source of image). I approximate a free cash flow yield at 6% without a lot of costs to run the business.

I bought Schmitt Industries ($SMIT) at two-times book value. They company is based in Portland, OR. In fact, their office is a two minute drive from one of my hiking spots in Forest Park.

Schmitt designs, manufactures and sells high precision test and measurement products, solutions and services via their Acuity and Xact product lines.

The Acuity product uses laser measurement sensors for dimensional measurement in a wide range of applications, including factory automation, surface profile scanning, crane positioning, road profiling, tire production, semiconductor manufacturing and many other industrial and commercial applications.

The Xact product uses satellite remote tank monitors include both ultrasonic and gauge reader sensors that provide remote fill level monitoring of propane, diesel and other tank-based liquids for tanks anywhere in the world.

Another very attractive aspect to Schmitt is they have a combined NOL for about $11-12 million at both the federal and state level, which could be used to offset future taxable income or otherwise payable taxes.

I’m most intrigued by the CEO Michael Zapata. I saw he was mentioned in William Green’s new book Richer, Wiser, Happier. I also listened to an interview with him on Invest Like The Best Podcast. Based on my research Mr. Zapata seems like an incredibly intelligent investor. In July 2020 Schmitt bought Ample Hills Creamery for an incredibly low price. He currently owns about 14-15% of the stock. Having an owner-operator is a double edged sword; things go really well and very poorly.

In Guy Spier’s book The Education of a Value Investor he discusses how by owning shares in a company you’re now in a relationship with management. From everything I’ve read I want to be in a relationship with Mr. Zapata.

The table below is a breakdown of my portfolio on June 30, 2021 after the close.

| Company | % |

| MU | 12.6% |

| BRK.B | 10.7% |

| PLXP | 9.6% |

| MKL | 6.7% |

| BAC | 5.9% |

| MMP | 3.6% |

| MO | 3.5% |

| SCHW | 3.4% |

| AIMFF | 2.3% |

| GVAL | 2.3% |

| EPD | 2.3% |

| GLRE | 2.2% |

| HII | 2.1% |

| EQC | 1.8% |

| ZIG | 1.8% |

| NEM | 1.7% |

| NOC | 1.5% |

| GD | 1.5% |

| OGZPY | 1.4% |

| KGC | 1.4% |

| EWY | 1.2% |

| ERUS | 1.2% |

| SMIT | 1.1% |

| LMT | 1.0% |

| XOM | 1.0% |

| BHF | 0.9% |

| PREKF | 0.9% |

| CVX | 0.7% |

| FNDC | 0.5% |

| EPOL | 0.5% |

| EWS | 0.4% |

| FRFHF | 0.4% |

| RTX | 0.4% |

| FFXXF | 0.3% |

| ICOL | 0.2% |

| EWUS | 0.1% |

| FPI | 0.0% |

| LAND | 0.0% |

| Cash | 0.8% |

| Gold | 3.0% |

| Platinum | 0.8% |

| Farmland | 4.1% |

| I Bonds | 2.1% |

Below is a breakdown by category:

| Bonds | 2.1% |

| Cash | 0.8% |

| Conglomerate | 10.7% |

| Defense | 6.5% |

| Financials | 10.2% |

| Insurance | 7.1% |

| International | 6.7% |

| Manager | 7.4% |

| Oil | 9.8% |

| Other | 3.5% |

| Pharma | 9.6% |

| Precious Metals | 6.9% |

| Real Estate | 6.0% |

| Semiconductor | 12.6% |

| Grand Total | 100.0% |