Disclaimer

Nothing discussed/written should be considered as investment advice. Please do your own research or speak to a financial advisor before putting a dime of your money into these crazy markets. In other words, if you buy something I bought, you deserve to lose your money.

The only reason why I am making my portfolio public because it provides accountability to me. Some or all the analysis I provide could be from the top of my head and should not be considered accurate.

My investing goal is simple; to try to manage risk while being fully invested without market timing. Howard Marks said it best, “even though we can’t predict, we can prepare.”

All my references to the Market are only for the US Market.

Performance

In Q1 I returned 10.25% compared to 10.67% for the S&P 500 (with dividends reinvested).

The table below is a breakdown of my portfolio at the end of Q1. What you see below where my entire net worth, excluding my home, is allocated.

| Company | % |

| AVDE | 1.1% |

| AVDV | 2.4% |

| AVES | 3.1% |

| AVIV | 1.7% |

| AVMV | 0.1% |

| AVSC | 0.0% |

| AVUV | 1.5% |

| BRK.B | 15.4% |

| BSBK | 0.1% |

| BTI | 2.3% |

| BWFG | 0.0% |

| CFSB | 0.1% |

| CLBK | 0.0% |

| CSV | 4.6% |

| CULL | 0.1% |

| DEEP | 0.6% |

| DFEV | 2.4% |

| DFIC | 1.3% |

| DFIV | 1.5% |

| DFSV | 1.4% |

| DISV | 1.5% |

| EPD | 3.2% |

| EQC | 0.8% |

| EWUS | 0.0% |

| FFBW | 0.3% |

| FPI | 0.5% |

| FRDM | 0.5% |

| FRFHF | 0.8% |

| FSEA | 0.1% |

| FYLD | 1.6% |

| GVAL | 2.6% |

| IVAL | 2.5% |

| LAND | 0.0% |

| MKC | 0.1% |

| MKL | 4.3% |

| NECB | 0.1% |

| PBBK | 0.1% |

| PREKF | 0.8% |

| RSBT | 1.1% |

| SYLD | 2.9% |

| TCBC | 0.1% |

| TCBS | 0.1% |

| WMPN | 0.1% |

| T Bills | 10.9% |

| Gold | 2.4% |

| Platinum | 0.6% |

| Farmland | 3.6% |

| I Bonds | 4.2% |

| Cash | 14.6% |

Below is a category breakdown:

| Bonds | 4.18% |

| Cash | 14.65% |

| Conglomerate | 15.40% |

| Consumer Staples | 0.11% |

| Financials | 1.19% |

| Funeral | 4.63% |

| Insurance | 5.13% |

| International | 21.99% |

| Managed Futures | 1.08% |

| Mid Cap Value | 2.98% |

| Oil/Gas | 4.02% |

| Precious Metals | 2.99% |

| Real Estate | 4.92% |

| Small Cap Value | 3.52% |

| T Bills | 10.92% |

| Tobacco | 2.27% |

Q1 Commentary

At the end of February I got laid off and my 401k was transferred to my brokerage account. The money is still in cash. I’ve been wrestling what to do with the money. Do I buy International ETFs? Do I hold cash, get 5% and wait for a better opportunity? The academic literature recommends not waiting and instead putting the money to work immediately. I don’t have any answers at the time of this writing.

After a nice gain in Citi I sold it because I realized I did not put in the work necessary to continue holding the stock. The proceeds are still in cash.

Below are charts and quotes I enjoyed during Q4 this year:

The story we tell ourselves is the most powerful one in the world. Eventually, we start believing it, even when it’s not true. While a positive story by itself won’t guarantee a good outcome, a negative one will certainly prevent it from happening. ~Farnam Blog

“If an idiot were to tell you the same story every day for a year, you would end by believing it.”

— Horace Mann

“Many of life’s failures are people who didn’t realize how close they were to success when they gave up.”

~ Thomas Edison“We can’t predict when the herd will come to its senses. But we do know that bear markets typically begin well before a recession becomes obvious.”

Source: https://www.broyhillasset.com/broyhill-blog/broyhill-letter-highlights-xi-lessons-from-history

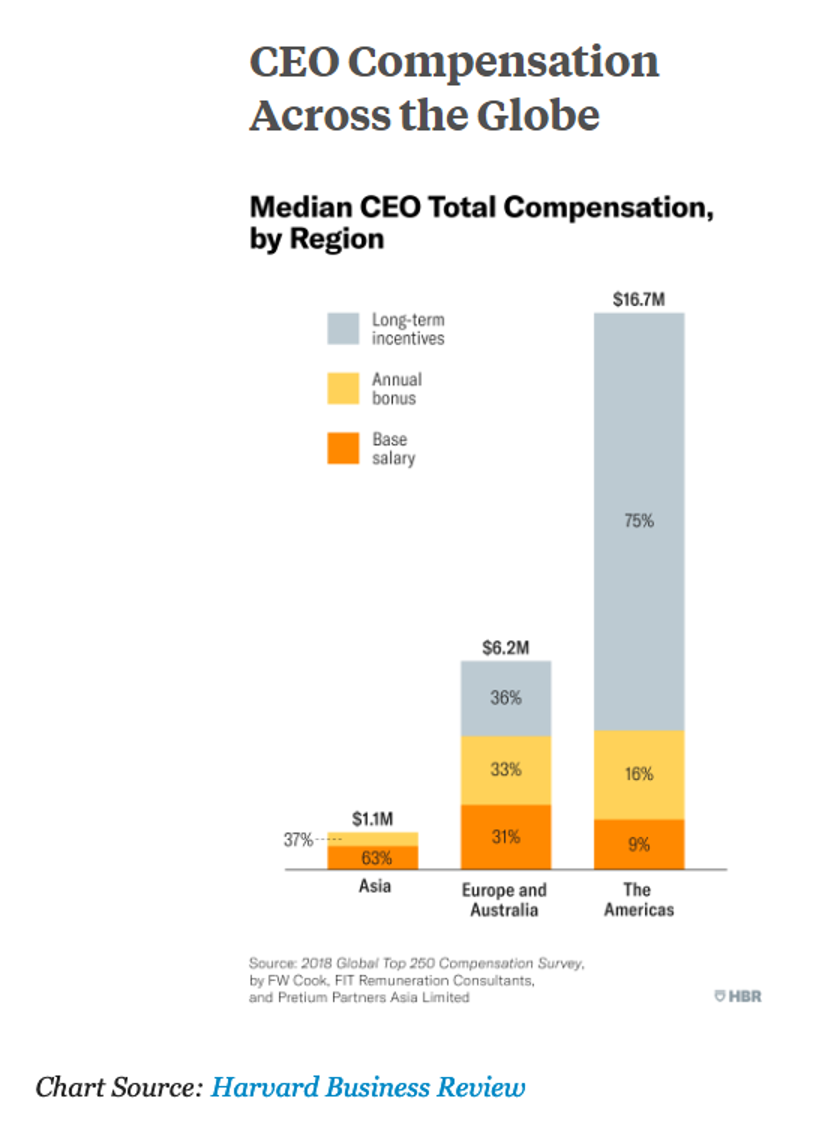

Source: https://hbr.org/2021/01/compensation-packages-that-actually-drive-performance

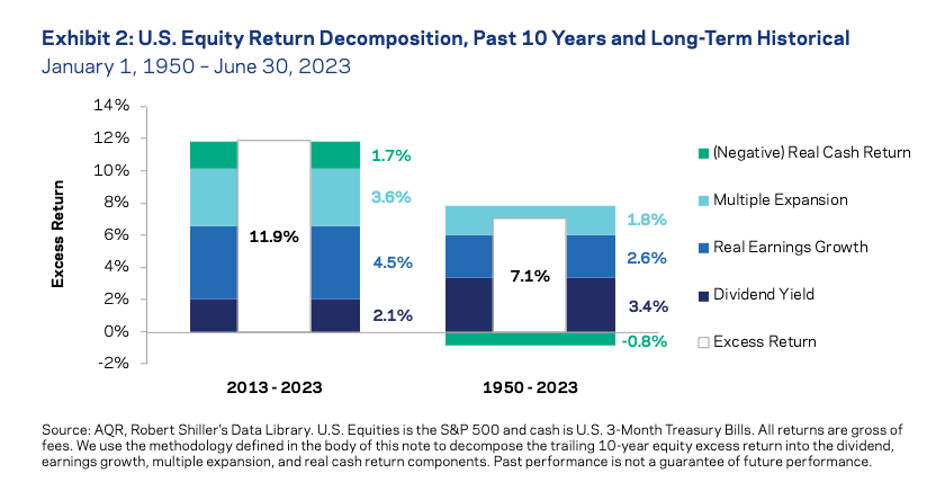

Source: https://www.aqr.com/Insights/Research/White-Papers/Driving-with-the-Rear-View-Mirror

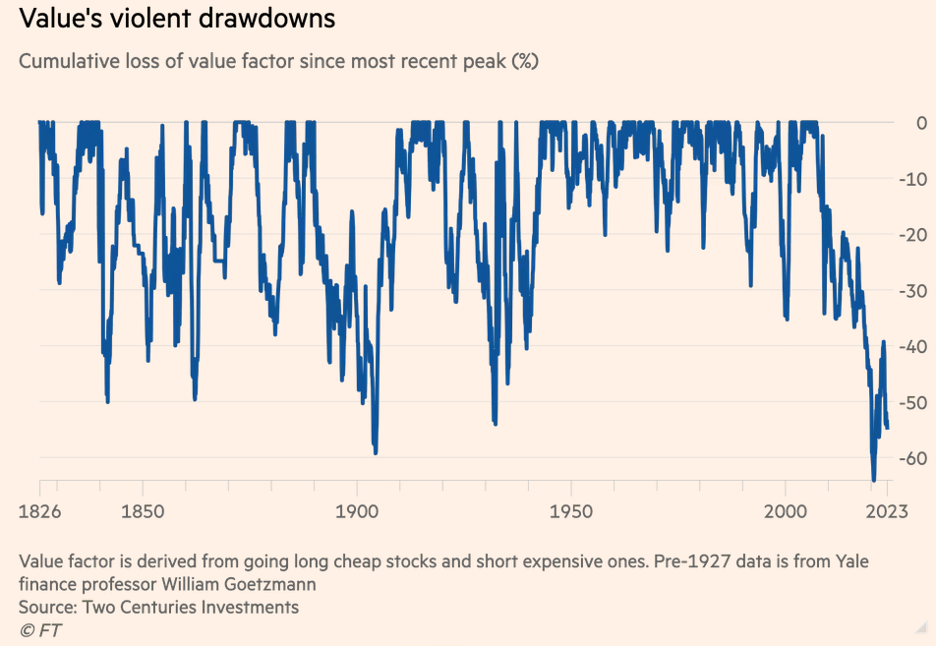

Source: https://www.ft.com/content/e0f98278-432e-4ece-b170-2c40e40d2835

A case for investing in U.S. Mid Caps. “In our experience, the $5-40B USD market capitalization range is that sweet spot where mid cap companies have established their competitive advantages and business models but often are still at a size where there is meaningful growth left in their runway.”