Disclaimer

Nothing discussed/written should be considered as investment advice. Please do your own research or speak to a financial advisor before putting a dime of your money into these crazy markets. In other words, if you buy something I bought, you deserve to lose your money.

The only reason why I am making my portfolio public because it provides accountability to me. Some or all the analysis I provide could be from the top of my head and should not be considered accurate.

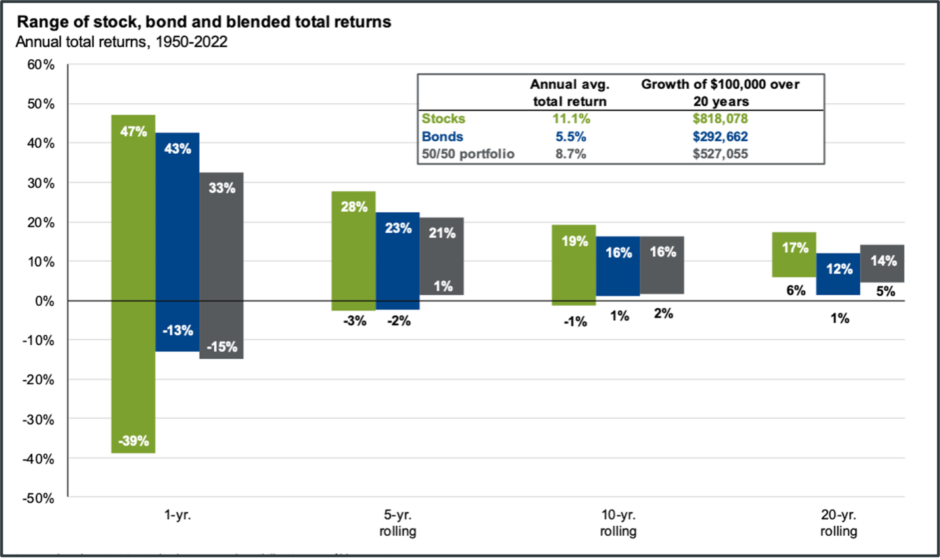

My investing goal is simple; to try to manage risk while being fully invested without market timing. Howard Marks said it best, “even though we can’t predict, we can prepare.”

All my references to the Market are only for the US Market.

Performance

For 2023 my portfolio returned 22.96% compared to 26% for the S&P 500 (with dividends reinvested).

The table below is a breakdown of my portfolio at the end of 2023. What you see below where my entire net worth, excluding my home, is allocated. Lastly, my 401k is 100% invested in a Small Cap Value Fund.

| Company | % |

| BRK.B | 14.4% |

| CSV | 5.5% |

| MKL | 4.5% |

| SYLD | 2.9% |

| MU | 2.8% |

| GVAL | 2.8% |

| EPD | 2.5% |

| AVES | 2.3% |

| DFEV | 2.3% |

| AVDV | 2.1% |

| C | 2.0% |

| IVAL | 1.9% |

| AVIV | 1.7% |

| DISV | 1.6% |

| AVUV | 1.6% |

| BTI | 1.5% |

| DFIV | 1.5% |

| DFSV | 1.4% |

| DFIC | 1.4% |

| AVDE | 1.2% |

| RSBT | 1.1% |

| FYLD | 1.1% |

| EQC | 1.0% |

| PREKF | 0.8% |

| FRFHF | 0.8% |

| DEEP | 0.6% |

| FPI | 0.6% |

| FRDM | 0.6% |

| FFBW | 0.3% |

| NECB | 0.2% |

| WMPN | 0.1% |

| TCBC | 0.1% |

| CULL | 0.1% |

| PBBK | 0.1% |

| TCBS | 0.1% |

| BSBK | 0.1% |

| CFSB | 0.1% |

| FSEA | 0.1% |

| AVSC | 0.0% |

| EWUS | 0.0% |

| BWFG | 0.0% |

| CLBK | 0.0% |

| LAND | 0.0% |

| T Bills | 9.0% |

| Gold | 2.5% |

| Platinum | 0.7% |

| Farmland | 4.0% |

| I Bonds | 4.6% |

| Cash | 1.8% |

| 401k | 11.7% |

Below is a category breakdown:

| Bonds | 4.62% |

| Cash | 1.82% |

| Conglomerate | 14.42% |

| Financials | 3.35% |

| Funeral | 5.54% |

| Insurance | 5.22% |

| International | 20.42% |

| Managed Futures | 1.14% |

| Mid Cap Value | 2.85% |

| Oil/Gas | 3.23% |

| Precious Metals | 3.12% |

| Real Estate | 5.51% |

| Semiconductor | 2.81% |

| Small Cap Value | 15.34% |

| T Bills | 9.04% |

| Tobacco | 1.54% |

Q4 Commentary

When gold first roughly $2,100 I sold about 40% of my physical gold and bought shares of SYLD. With my dividend income I bought more EPD and BTI. I also sold out of my Aimia position because I didn’t like their governance. Specifically, choosing to give a $3.10 placement to insiders “after robust arms length negotiations”.

Below are charts and quotes I enjoyed during Q4 this year:

“Some argue that holding significant cash is gambling, that being less than fully invested is akin to market timing. But isn’t a yes or no decision the crucial one in investing? Where does it say that investing means always buying something, even the best of a bad lot? An investor who can’t or won’t say no forgoes perhaps the most valuable tool available to investors.” —Seth Klarman

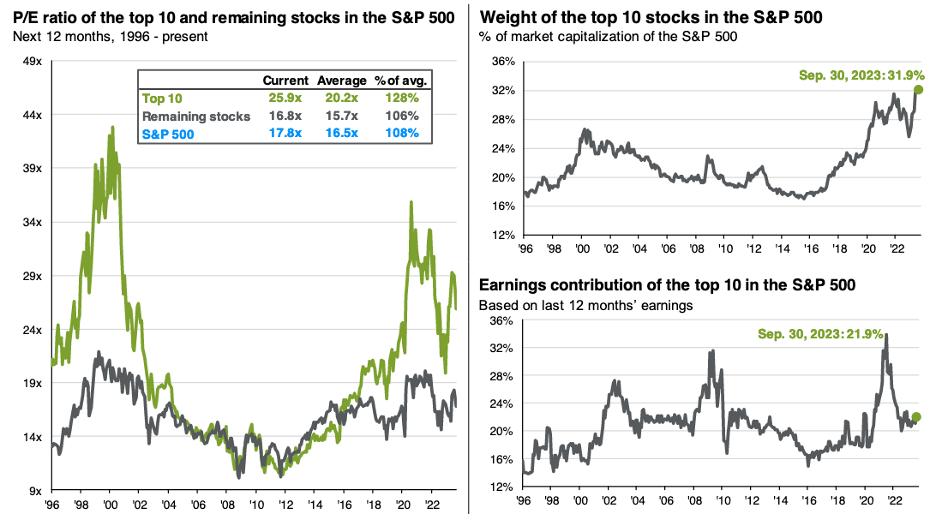

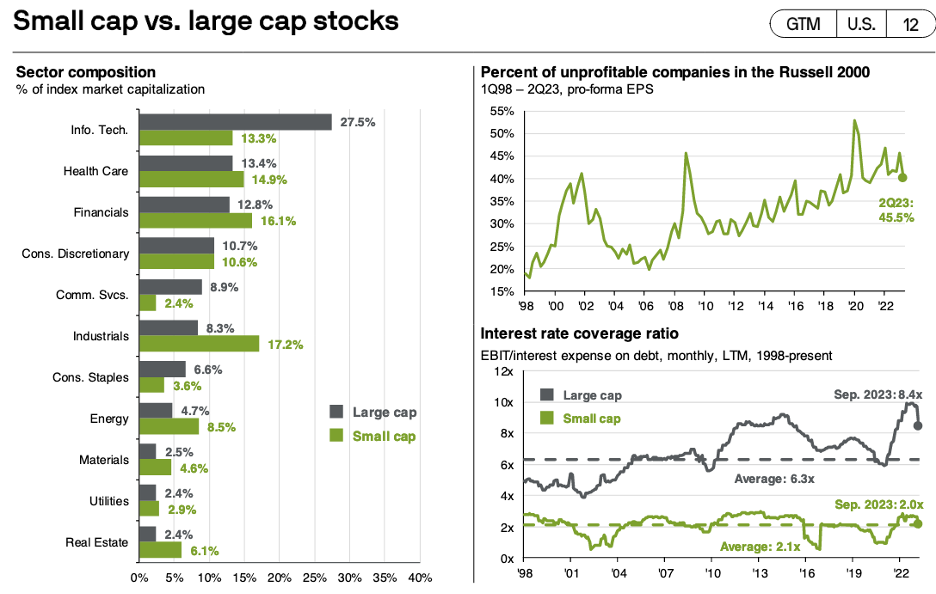

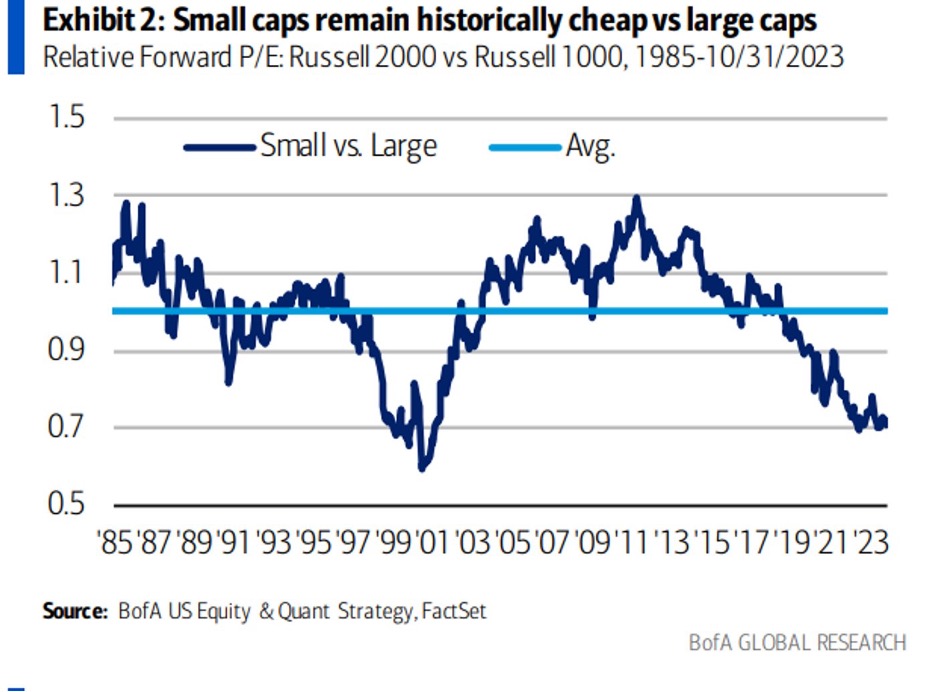

“The good news for small-cap investors, as Spencer Jakab points out, is that over the past 11 recessions, small-caps have beaten larger-caps by over 16% in the 12 months after the recession started and have done quite well in previous recoveries. For example, from 2001 through 2004 (the period following the dot-com bust), the S&P 500 lost about 2% but the Russell 2000 value gained 80%. The historical record supports small-cap value’s outperformance, with the annualized return of small-cap value more than 400 bps higher than that of larger-cap growth companies since 1926 (through July of 2023), according to data provided by Nobel Prize-winning economists Eugene Famma and Kenneth French.

However, investors in small-cap companies should be especially wary (and this is why good stocking picking in this area of the market is so important) of potential minefields: 45.5% of the companies in the Russell 2000 are unprofitable, and their EBIT (earnings before interest and taxes) covers a much smaller percentage of their interest expense than among their large-cap brethren. (For further details, see the accompanying chart.) ”

Source: https://boyarresearch.substack.com/p/boyar-researchs-q3-letter

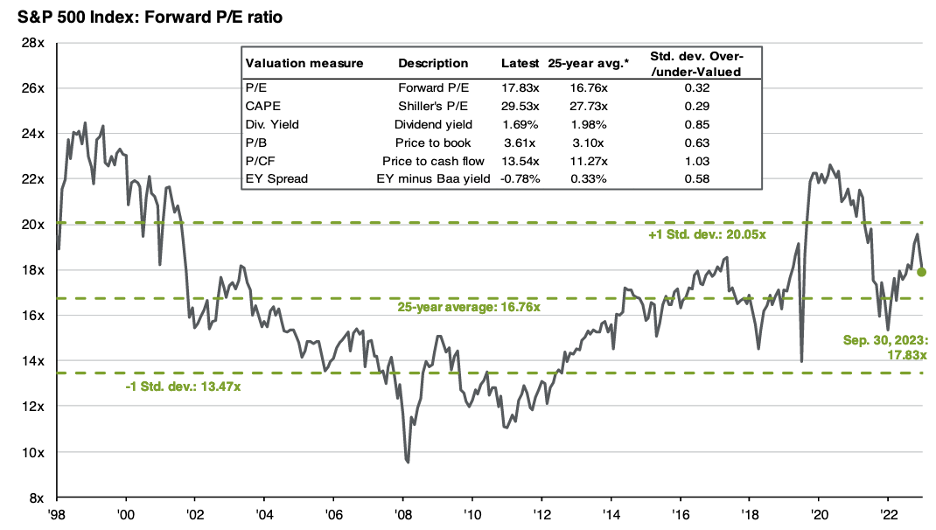

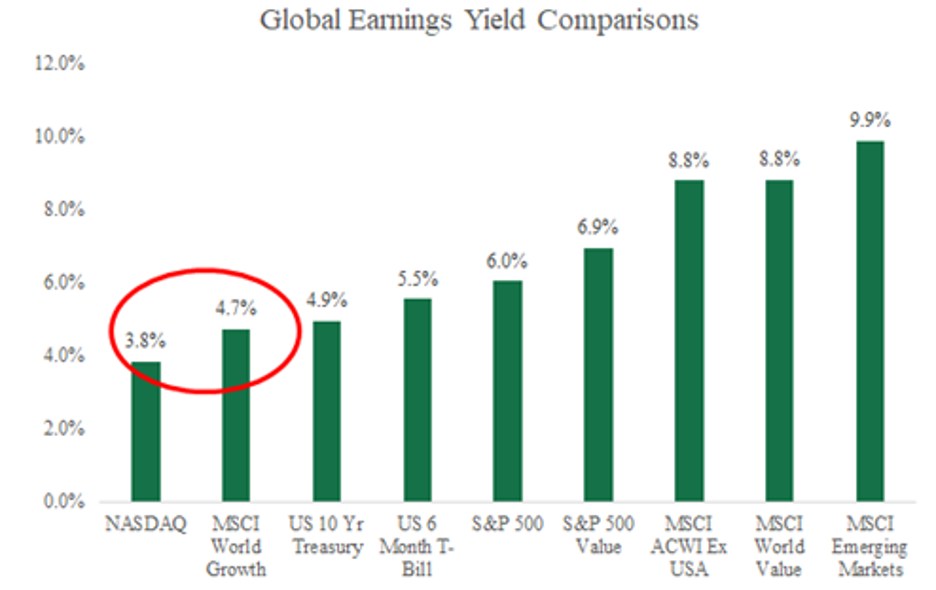

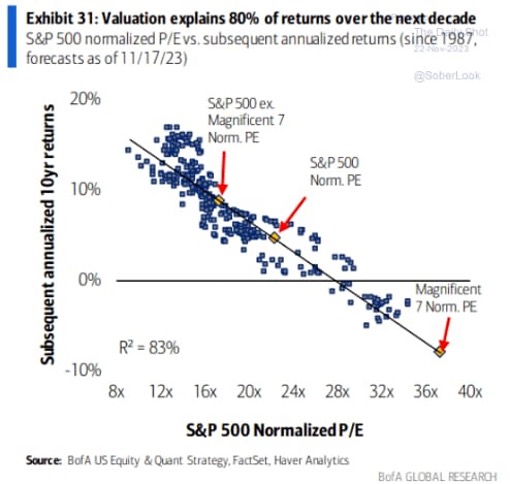

“This idea that, at the right price, growth can be a value is terribly confusing to those who treat growth as the opposite of value. The opposite of cheap isn’t growth; it’s expensive. So instead of looking at growth versus value, we look at low P/E versus high P/E. A convenient way is to rank order the S&P 500 by P/E ratio, comparing number 50 to number 450. Currently, the 50th lowest P/E stock sells just over 8 times earnings, and the 50th highest sells at 60. So, the highest priced stocks are about 7 times more expensive than the lowest priced. Over the 30-plus years we have data, the P/E ratio averages about 4, bouncing between 3 and 5. (So, if there are 50 stocks below 10 times earnings, there are 50 over 40.) It was meaningfully higher only one time—when it hit 9 times at the end of the internet and tech bubble in 2000.”

Source: Bill Nygren https://oakmark.com/news-insights/value-vs-growth-then-and-now-u-s-equity-market-commentary-3q23/

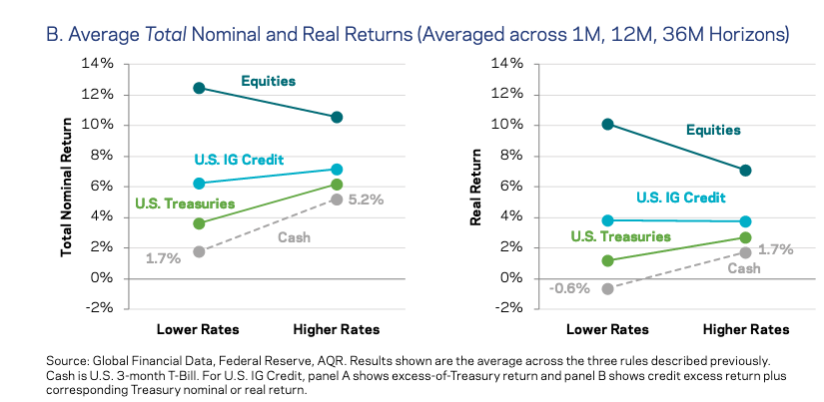

Source: https://www.aqr.com/Insights/Research/Alternative-Thinking/Honey-the-Fed-Shrunk-the-Equity-Premium

Source: https://boyarresearch.substack.com/p/boyar-researchs-q3-letter

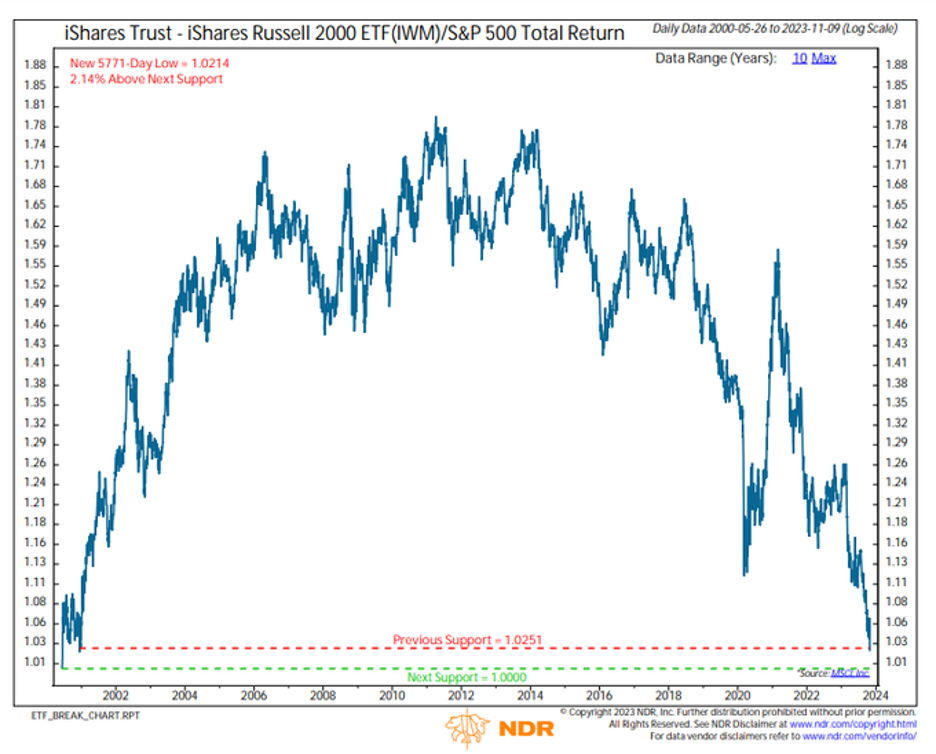

Small-caps are trading at their lowest level vs. the S&P 500 (total return) in almost 23 years.

Source: https://twitter.com/_rob_anderson/status/1723004783492042962

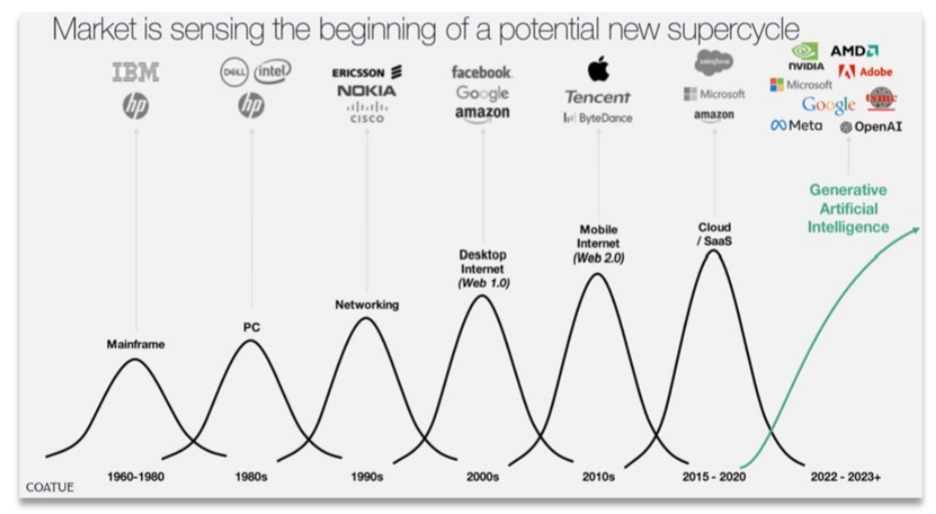

Apollo on asset price bubbles since 1970.

Small-caps are the cheapest size segment by market capitalization, trading at a 19% discount to historical averages

Midcap stocks are trading at a 4% discount.

Large-cap stocks are trading at a 12% premium to historical averages

Megacap stocks, represented by Russell Top 200 XX:RT200, are trading at a 18% premium.

Source: https://twitter.com/Greenbackd/status/1724456892477681879

Source: https://app.hubspot.com/documents/22324760/view/718167065?accessId=126fb9

Source: https://www.ft.com/content/2e1a235a-8a46-47f3-b040-5ca21a04ebf4