Disclaimer

Nothing discussed/written should be considered as investment advice. Please do your own research or speak to a financial advisor before putting a dime of your money into these crazy markets. In other words, if you buy something I bought, you deserve to lose your money.

The only reason why I am making my portfolio public because it provides accountability to me. Some or all the analysis I provide could be from the top of my head and should not be considered accurate.

My investing goal is simple; to try to manage risk while being fully invested without market timing. Howard Marks said it best, “even though we can’t predict, we can prepare.”

All my references to the Market are only for the US Market.

Performance

During Q2 of 2023 my portfolio returned 15.18% compared to 16.89% for the S&P 500 (with dividends reinvested).

The table below is a breakdown of my portfolio at the end of Q2 2023. What you see below where my entire net worth, excluding my home, is allocated. Lastly, my 401k is 100% invested in a Small Cap Value Fund.

| BRK.B | 14.6% |

| MU | 8.1% |

| CSV | 7.6% |

| MKL | 4.6% |

| GVAL | 3.3% |

| AIMFF | 3.1% |

| EPD | 2.6% |

| DFEV | 2.4% |

| AVES | 2.3% |

| C | 1.9% |

| AVIV | 1.7% |

| BTI | 1.6% |

| AVDV | 1.5% |

| DISV | 1.5% |

| DFIV | 1.5% |

| AVUV | 1.4% |

| DFSV | 1.3% |

| DFIC | 0.9% |

| PREKF | 0.8% |

| DEEP | 0.6% |

| RSBT | 0.5% |

| IVAL | 0.5% |

| FFBW | 0.3% |

| AVDE | 0.3% |

| NECB | 0.2% |

| PBBK | 0.1% |

| TCBC | 0.1% |

| CULL | 0.1% |

| WMPN | 0.1% |

| TCBS | 0.1% |

| CFSB | 0.1% |

| BSBK | 0.1% |

| FSEA | 0.1% |

| AVSC | 0.0% |

| EWUS | 0.0% |

| BWFG | 0.0% |

| CLBK | 0.0% |

| LAND | 0.0% |

| FPI | 0.0% |

| T Bills | 9.6% |

| Gold | 2.9% |

| Platinum | 0.6% |

| Farmland | 3.8% |

| I Bonds | 7.0% |

| Cash | 0.5% |

| 401k | 9.6% |

Below is a category breakdown:

| Bonds | 6.97% |

| Cash | 0.52% |

| Conglomerate | 14.56% |

| Financials | 3.24% |

| Funeral | 7.56% |

| Insurance | 4.58% |

| International | 15.96% |

| Managed Futures | 0.48% |

| Manager | 3.10% |

| Oil/Gas | 3.37% |

| Precious Metals | 3.57% |

| Real Estate | 3.84% |

| Semiconductor | 8.06% |

| Small Cap Value | 12.96% |

| T Bills | 9.63% |

| Tobacco | 1.60% |

Commentary

I sold all my shares of MMP, INTC, HII and LMT. Currently, there is a proposal by Oneok, Inc. to buy Magellan Midstream Partners. I personally do not like the deal. I think Magellan’s management is selling itself for too cheap of a price. Magellan is selling itself for about $65 a share and I think the value of the stock is somewhere in the $80s. If the deal doesn’t go through I’ll re-buy the shares. The shares were sold in my Roth IRA which means I’ll never have to pay taxes on my gains.

I finally moved on from my Intel bet. I’ve met some employees who work them and from what I can gather is the company is a bureaucratic mess and I no longer wanted to invested in a company with a bad culture.

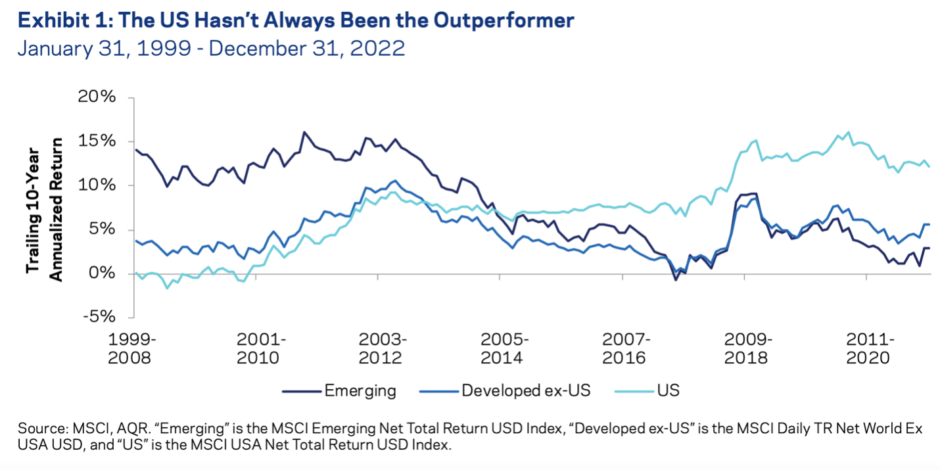

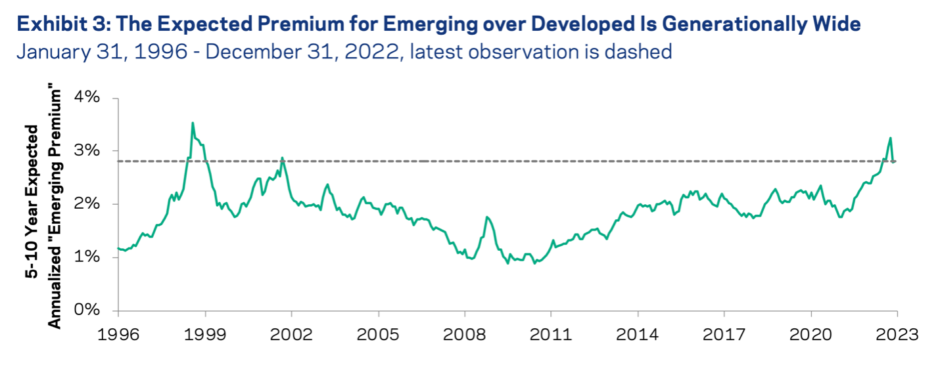

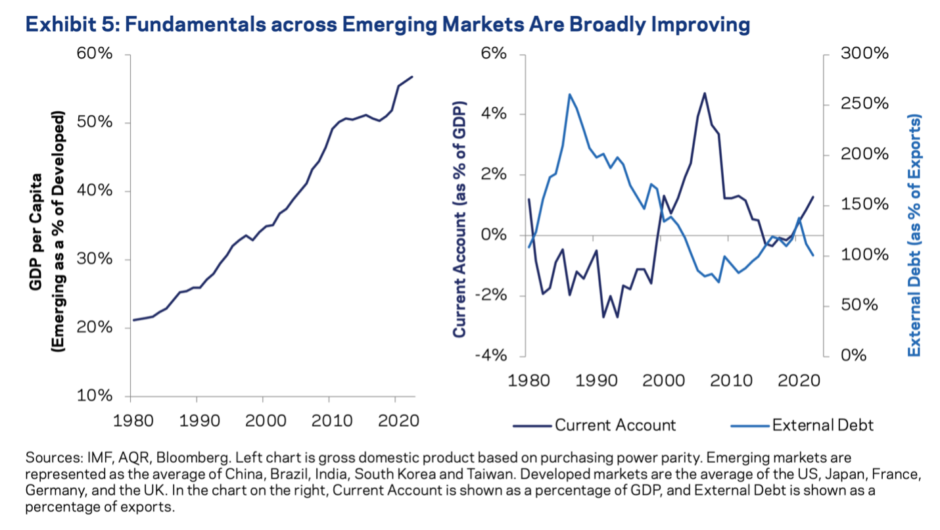

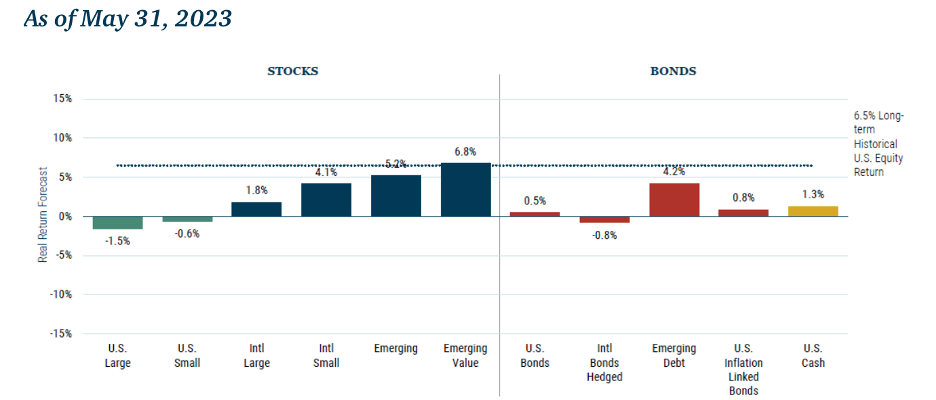

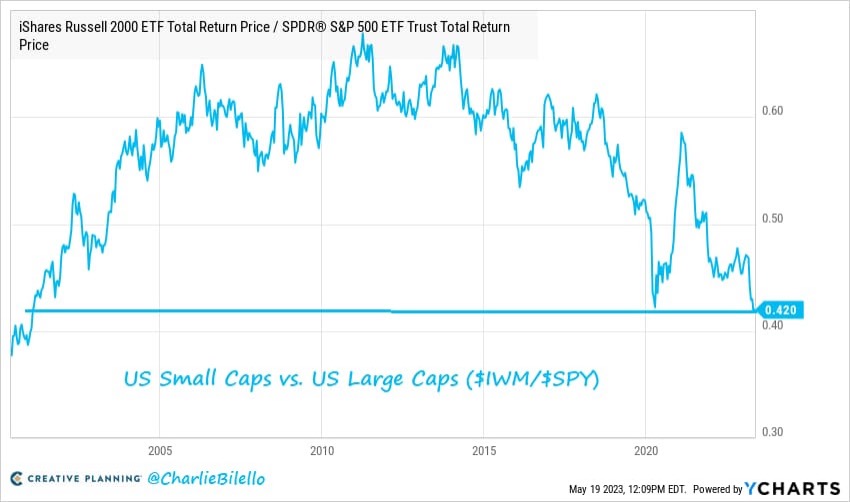

Lockheed Martin and Huntington Ingalls Industries were tiny positions and I sold both at a reasonable profit. These were sold because I believe there is bigger opportunity for Emerging Markets and US Small Cap Value. The vast majority of the proceeds from the selling was given to Emerging Market and International ETFs. I did add a tiny bit to British American Tobacco, Citigroup and Berkshire Hathaway.

I also created new positions in DEEP and RSBT. The former is the Roundhill Acquirers Deep Value. On a recent Meb Faber podcast, Ben Inker & Tom Hancock from GMO said the lowest 20% of Value (i.e. deep value) was incredibly cheap. RSBT is a Bonds & Managed Futures that utilizes return stacking. The primary reason why I wanted exposure to this ETF is because I wanted access to managed futures, which historically, has been diversifier from stocks AND has done well in inflationary periods. Basically the ETF provides bonds exposure stacked with managed futures.

In regards to Carriage Services, management is considering an offer from Park Lawn. That’s all that is publicly known right now. I have a sneaky suspicion that, like MMP, the price will be too low.

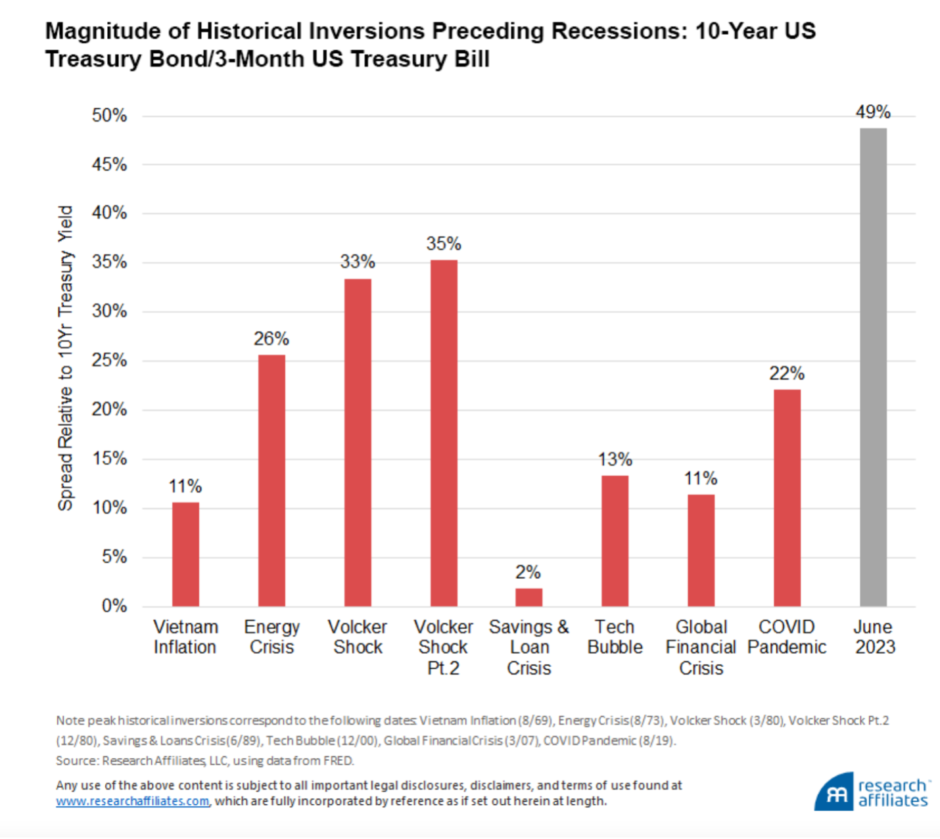

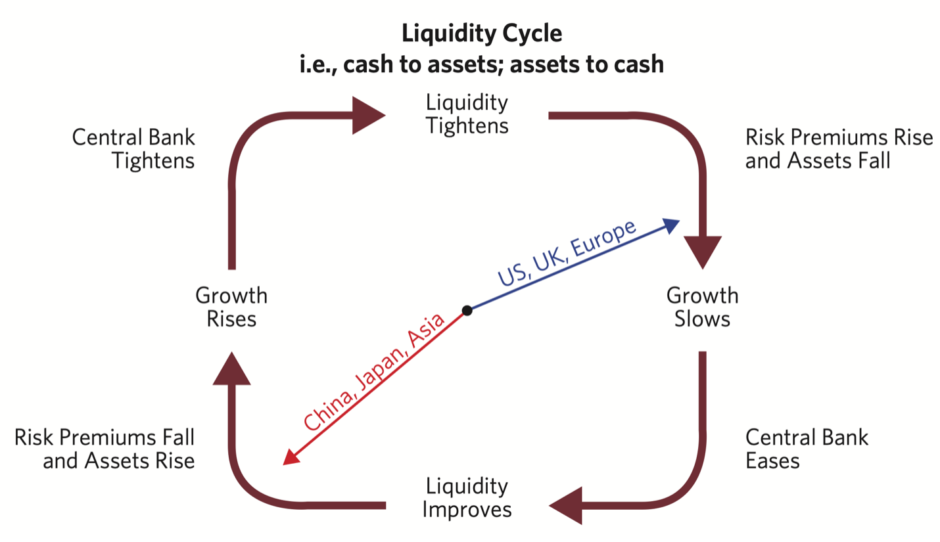

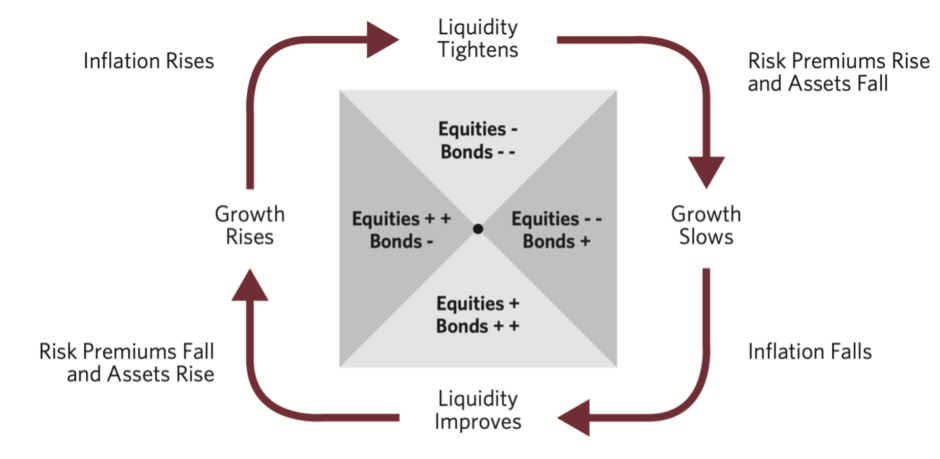

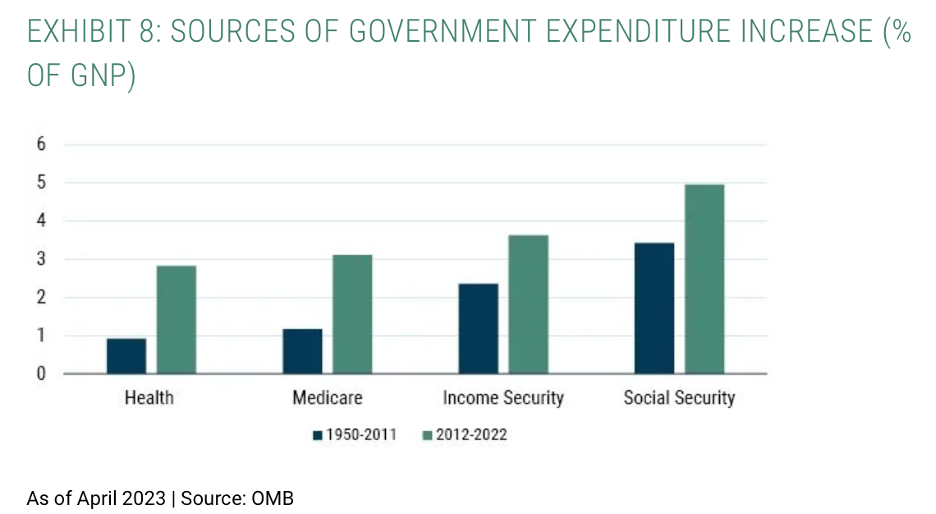

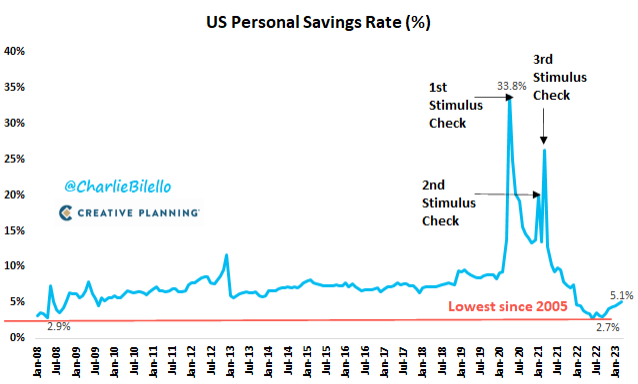

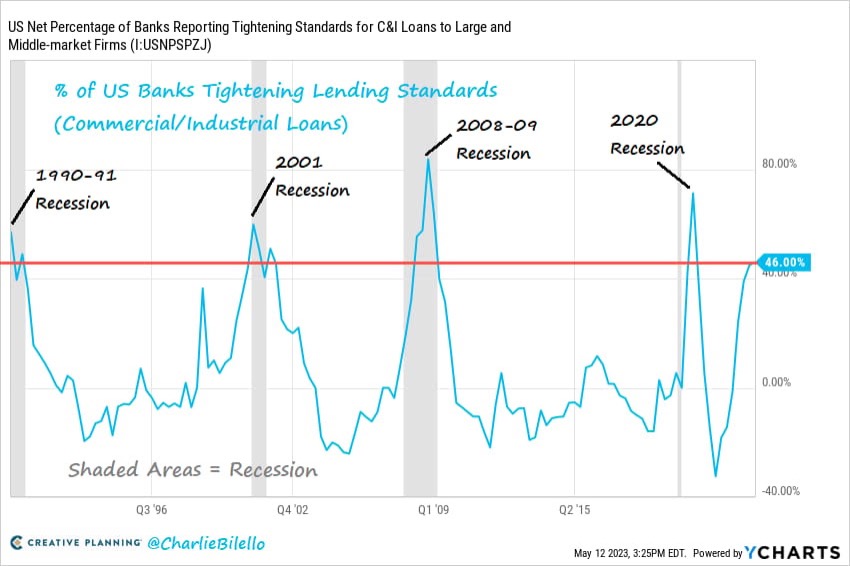

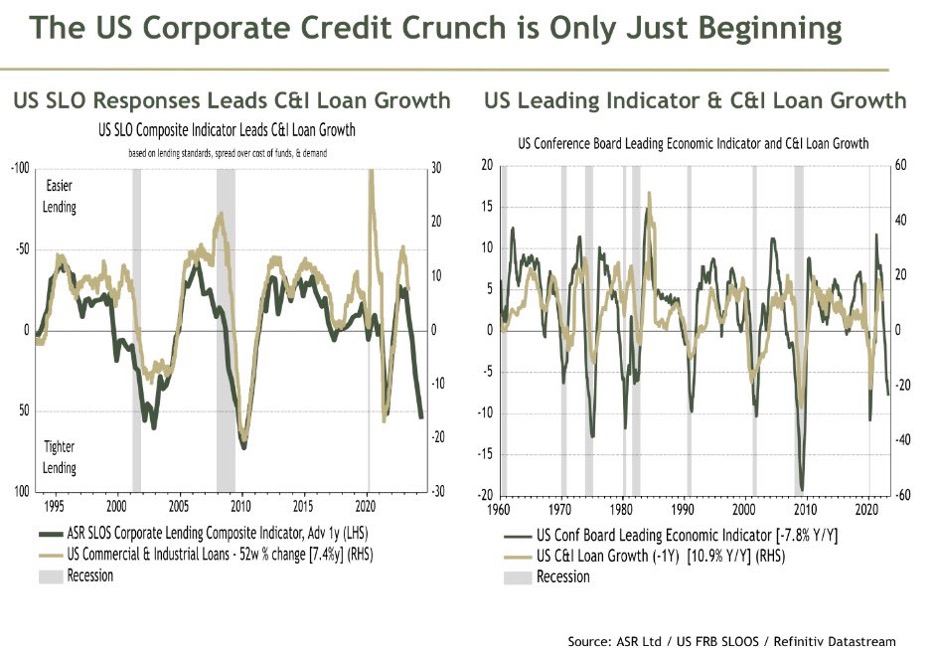

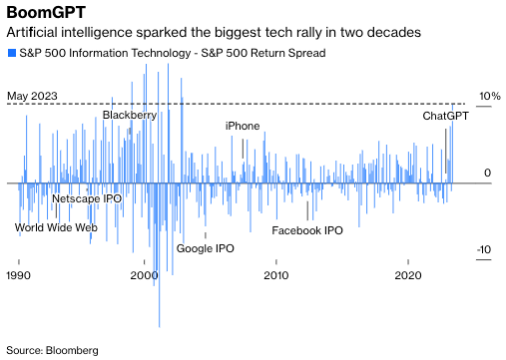

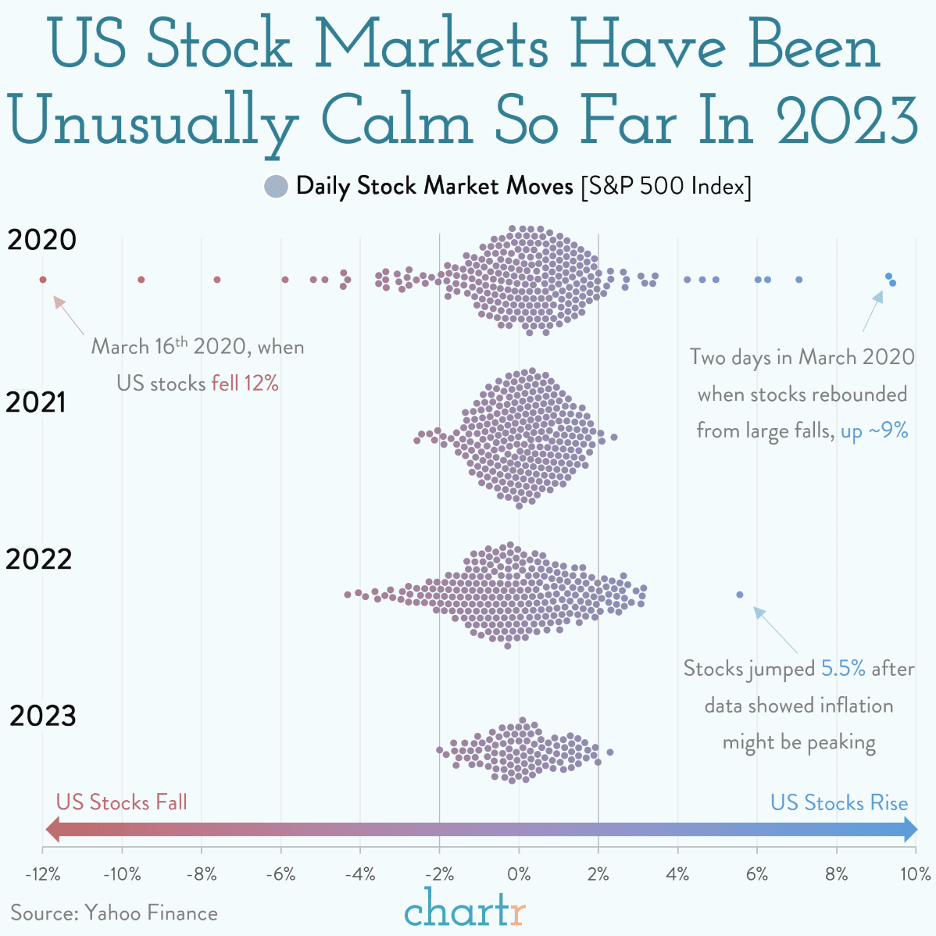

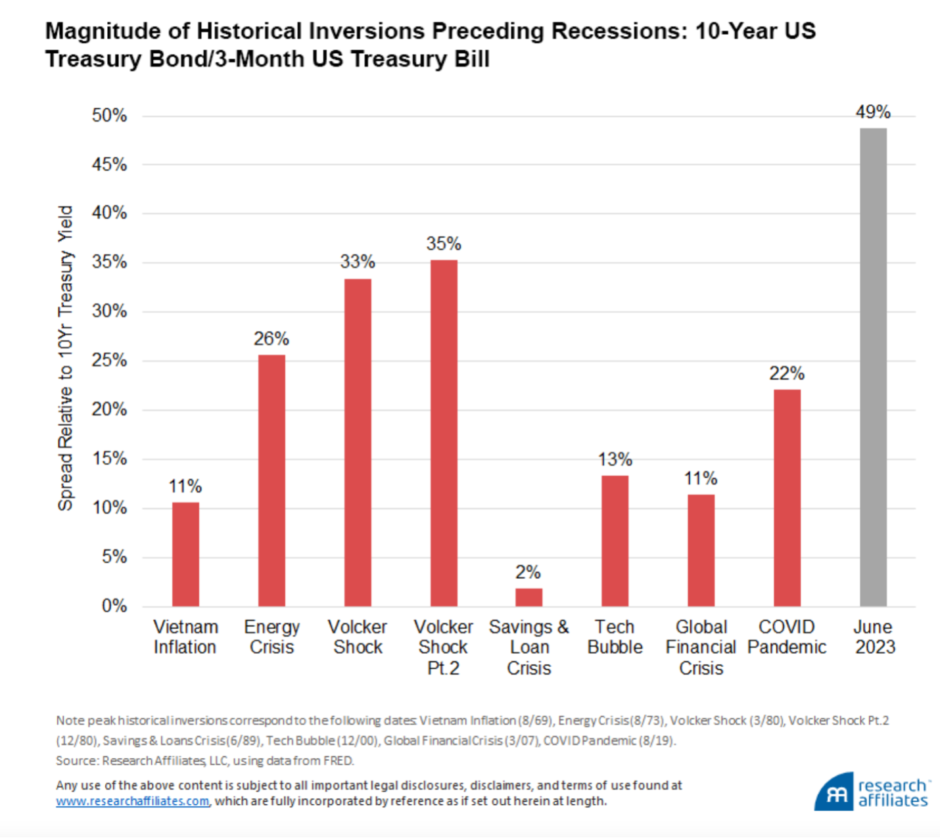

At the beginning of the year I was a fully invested bear. I was bearish but I didn’t reduce my exposure to stocks this year. I still think there’s a going to be a crash because I think wage inflation is real and the Federal Reserve needs to cool down the economy. Also, a lot of corporate debt needs to be refinanced in 2027 which means that debt will be refinanced in 2025 and 2026 which means the Market will start pricing that in 2024.

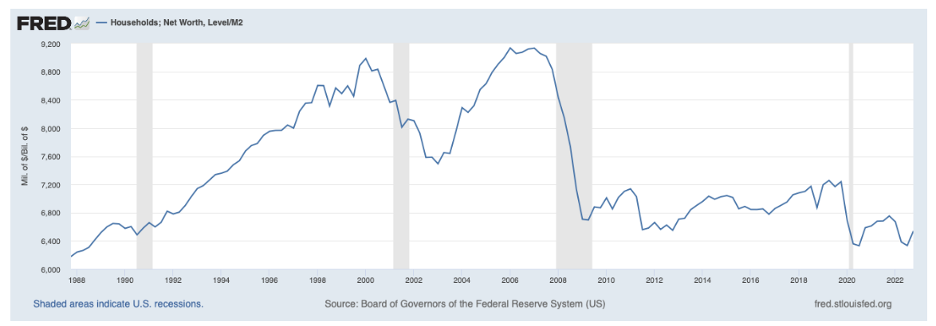

Below are charts and quotes I enjoyed during Q2 this year:

“My favorite 11th commandment is, ‘Thou shalt not take oneself seriously.’ You need to constantly challenge your own thoughts.” —Sam Zell

“The one thing I will tell you is the worst investment you can have is cash. Everybody is talking about cash being king and all that sort of thing. Cash is going to become worth less over time. But good businesses are going to become worth more over time. And you don’t want to pay too much for them so you have to have some discipline about what you pay. But the thing to do is find a good business and stick with it. We always keep enough cash around so I feel very comfortable and don’t worry about sleeping at night. But it’s not because I like cash as an investment. Cash is a bad investment over time. But you always want to have enough so that nobody else can determine your future essentially.” —Warren Buffett

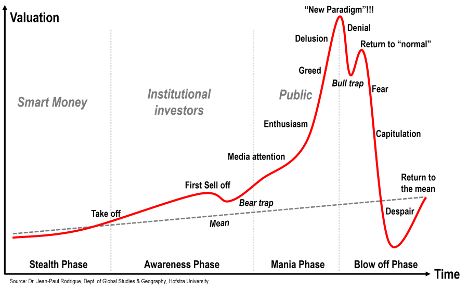

“I’ve been thinking lately about the fact that being an investor requires a person to be somewhat of an optimist. Investors have to believe things will work out and that their skill will enable them to wisely position capital for the future. Equity investors have to be particularly optimistic, as they have to believe someone will come along who’ll buy their shares for more than they paid. My point here is that optimists surrender their optimism only grudgingly, and phenomena such as cognitive dissonance and self-delusion permit opinions to be held long after information to the contrary has arrived. This is among the reasons why they say of the stock market: “Things can take longer to happen than you thought they would, but then they happen faster than you thought they could.” Today’s sideways or “range-bound” market tells me investors possess a good amount of optimism despite the worries that have arisen. In the coming months, we’ll find out if the optimism was warranted.” Howard Marks

“It has taken me years to unlearn everything I was taught, and I probably haven’t succeeded yet. I cite this only because most of what has been written about the market tells you the way it ought to be, and the successful investors I know do not hold to the way it ought to be, they simply go with what is.” —George Goodman

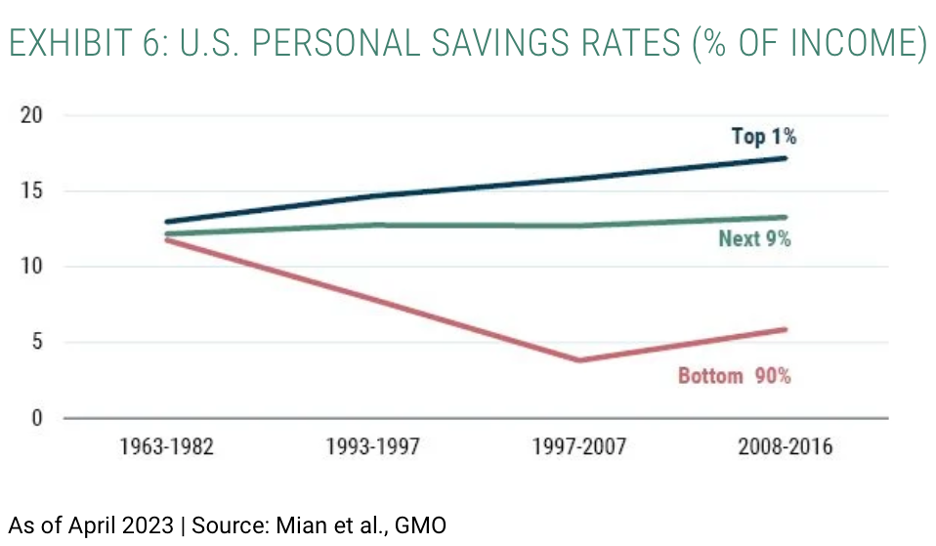

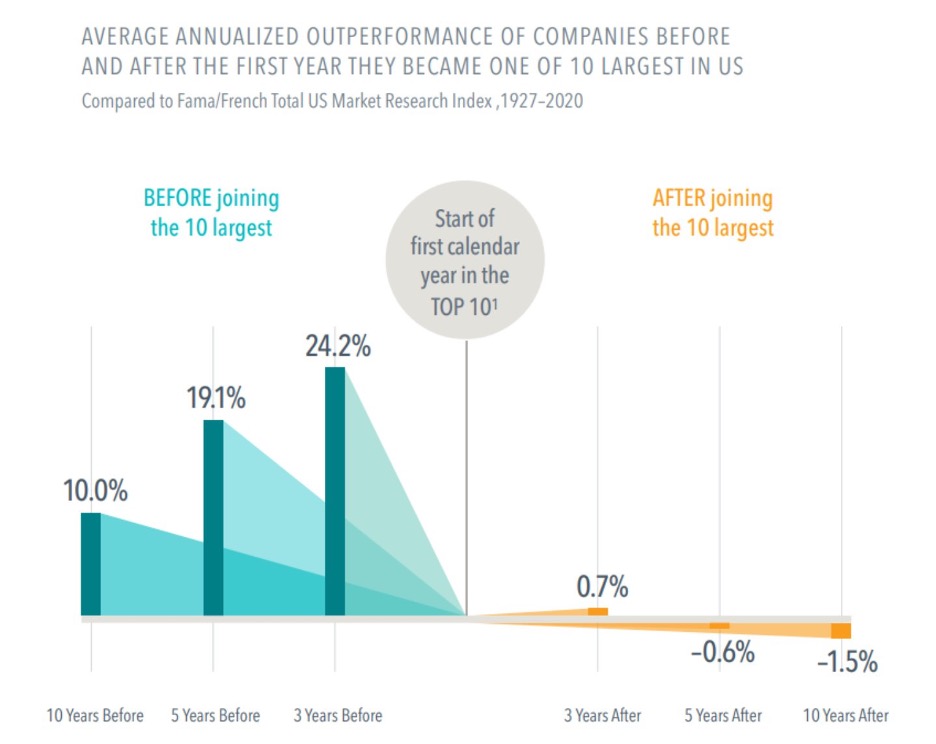

- 55.2% of U.S. stocks and 57.4% of non-U.S. stocks underperform one-month U.S. Treasury bills in terms of compound returns over the full sample

- The top-performing 2.4% of firms account for all of the $US 75.7 trillion in net global stock market wealth creation from 1990 to December 2020

- Outside the US, 1.41% of firms account for the $US 30.7 trillion in net wealth creation

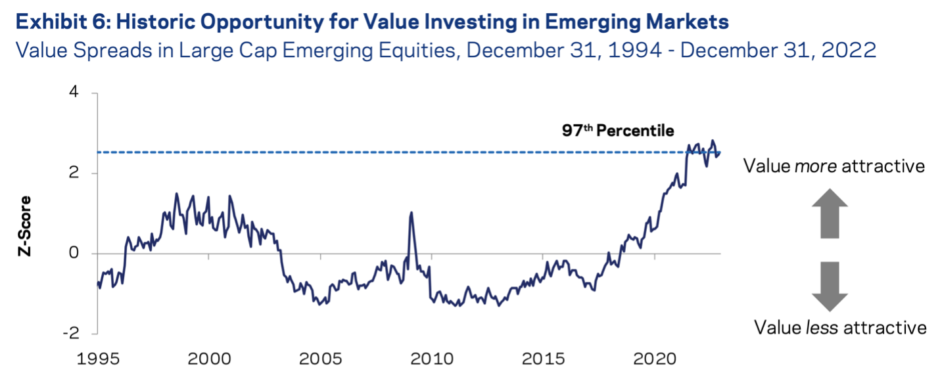

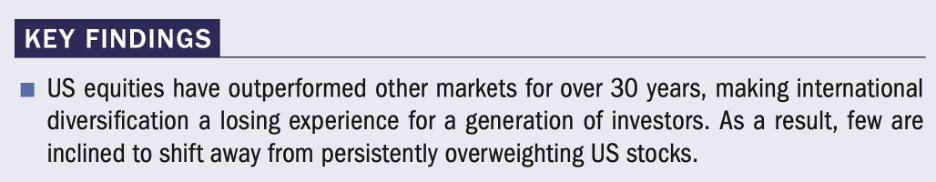

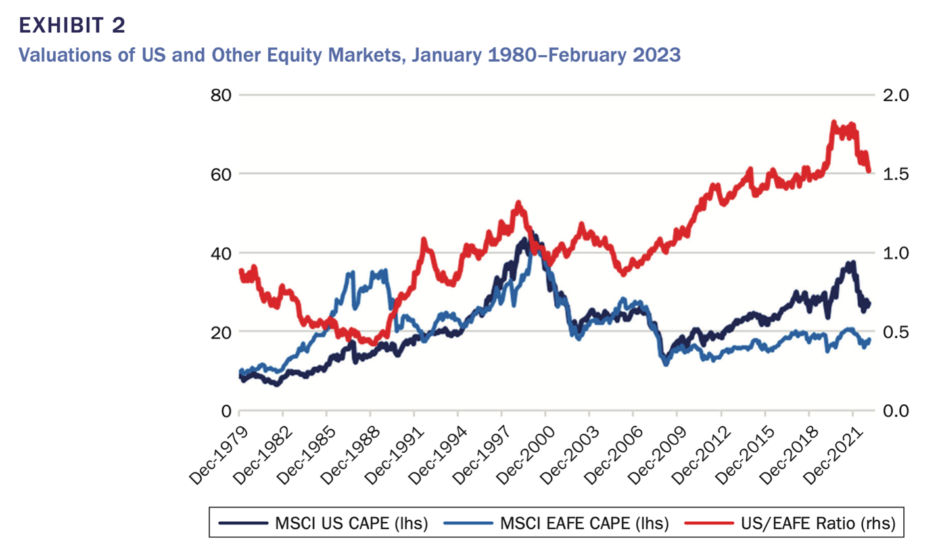

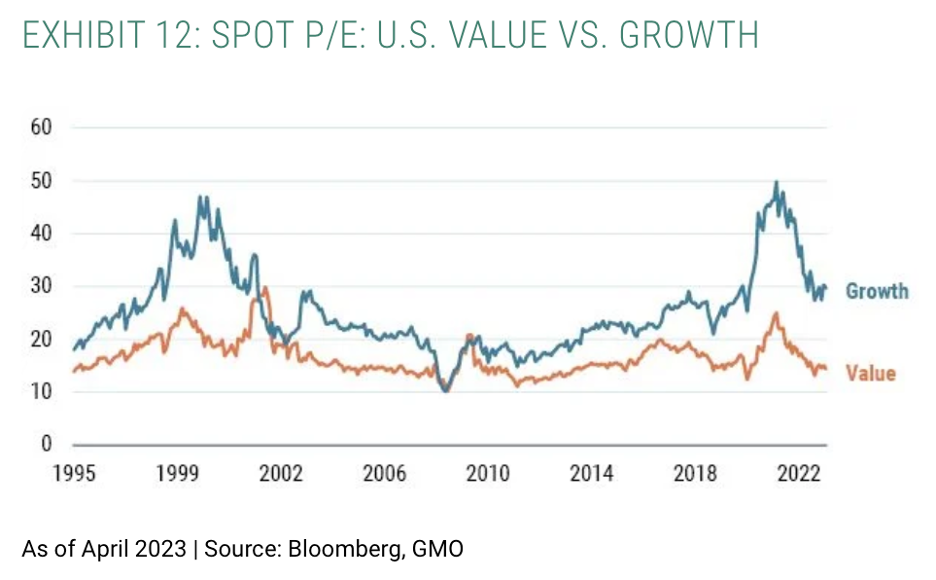

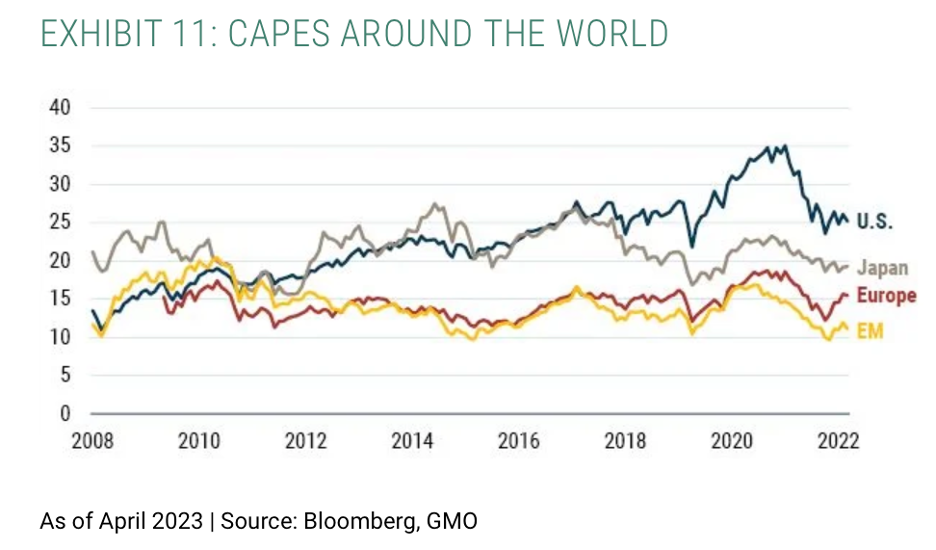

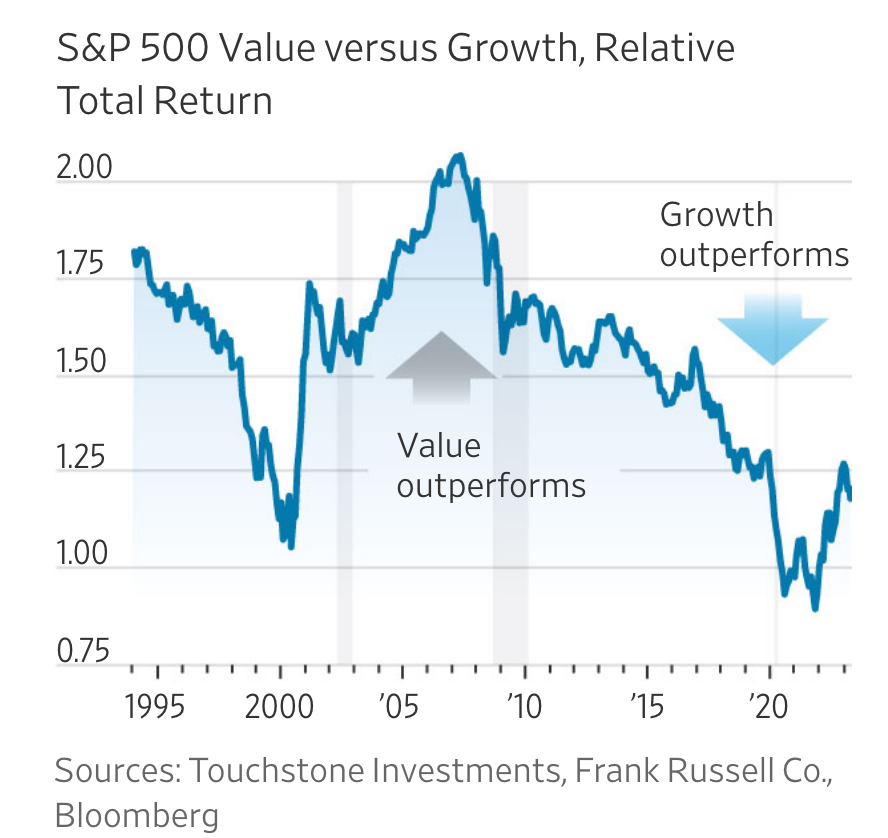

“Exhibit 2 shows that the relative valuations (using the Shiller CAPE ratio) between US and EAFE equities kept increasing through the 2010s and rose to a historic high of 1.8 in 2020–2021. The relative CAPE ratio fell in 2022 but remains extremely wide. The positive story is that the US is rich for a reason—it is indeed hard to love European or Japanese equities except for valuation reasons.18 But valuations count. Historically, value strategies outperform, but not because they pick better companies (or here, better countries), rather because the discount/premium in the worse/better companies (or countries) was too extreme.”

Source: https://twitter.com/MebFaber/status/1663990721593090058/photo/1

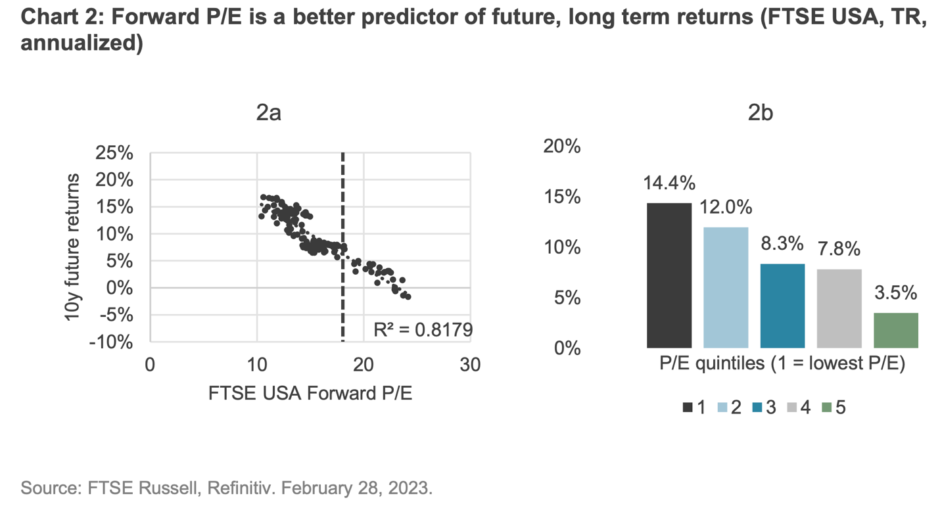

“A core concern for investors contemplating taking advantage of the incredible cheapness of deep value stocks today is the potential for a near-term recession. A common perception is that value stocks are more cyclical and therefore more vulnerable to economic downturn.

We find that this conventional wisdom is false: empirical evidence shows that value stocks actually tend to outperform in recessions. Value stocks have the charm of low expectations. No one is expecting all that much from them, so they have less to lose in an economic environment in which companies of all stripes wind up having a tough time.

Based on current valuations, deep value is priced to significantly outperform the rest of the market. Our analysis suggests that the prospect for deteriorating economic conditions in no way impairs this thesis.”

Source: https://www.gmo.com/americas/research-library/value-does-just-fine-in-recessions_whitepaper/

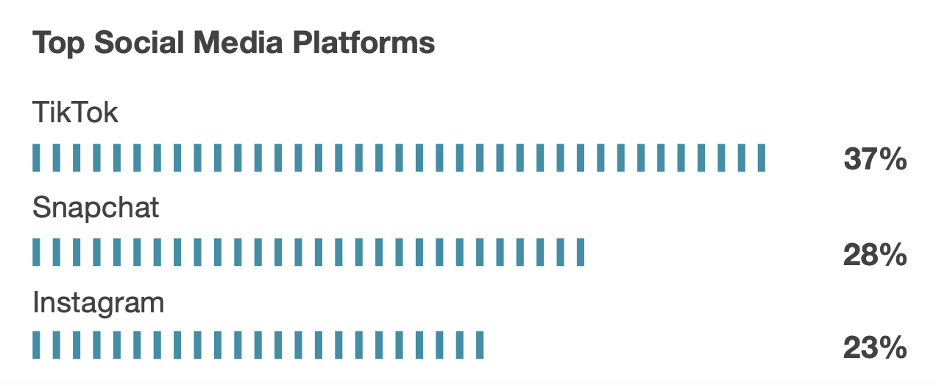

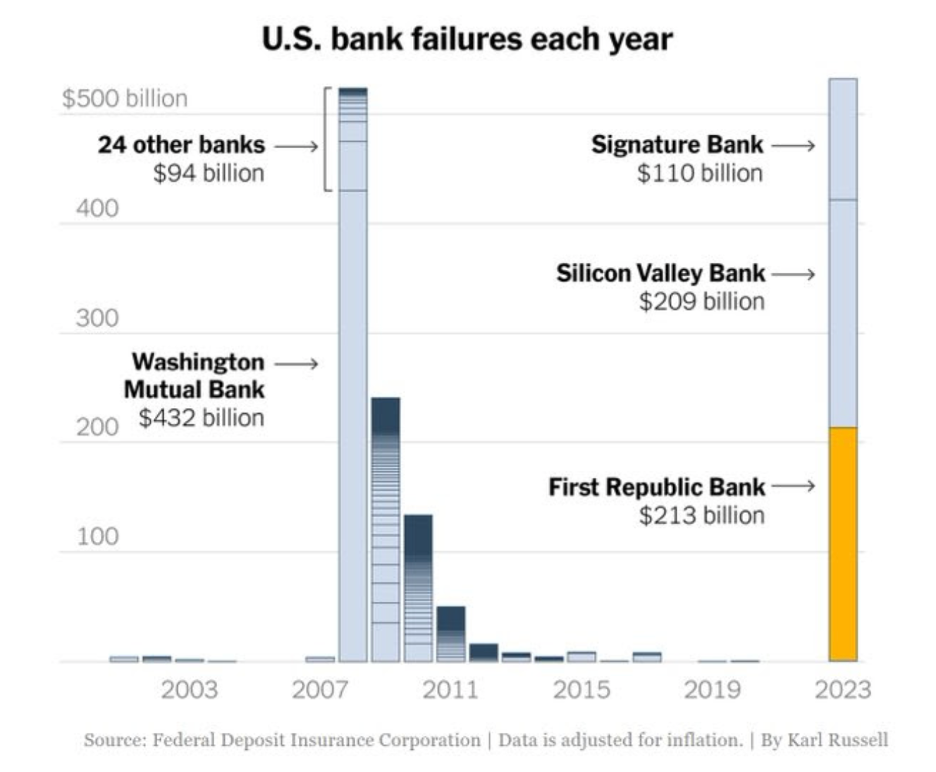

Source: https://www.chartr.co/newsletters/2023-05-29

Source: https://www.wsj.com/articles/investing-value-stocks-2be29ad9

“A common perception is that value stocks are more cyclical and therefore more vulnerable to economic downturn,” he said in a white paper. “We find that this conventional wisdom is false.”

Source: https://www.barrons.com/articles/value-stocks-cheap-recession-research-e59349e8

“Our analysis shows price-to-book can provide a similar expected return with lower turnover and more control over the exposures to multiple premiums in a systematic investment solution.”

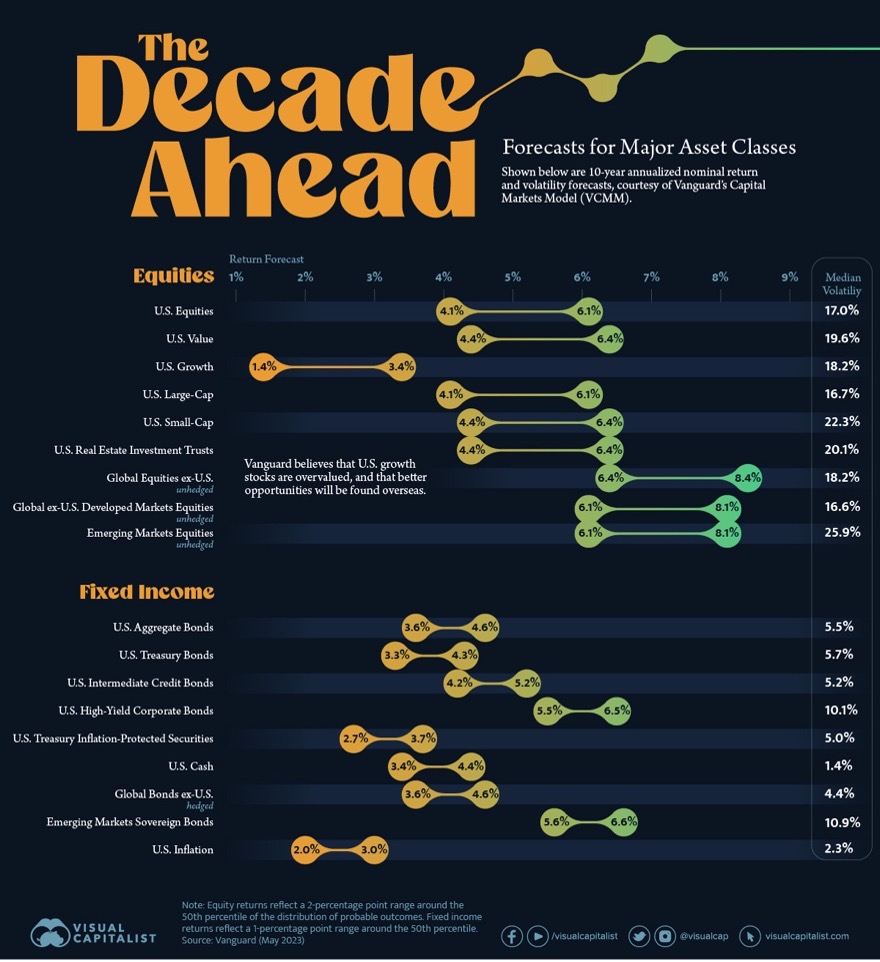

Source: https://www.visualcapitalist.com/10-year-annualized-forecasts-for-major-asset-classes/

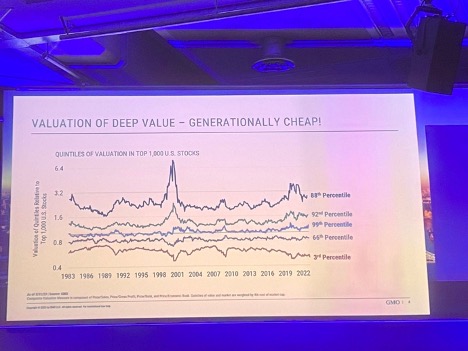

“He mined GMO’s database looking at the difference between deep value (the cheapest quintile) and shallow (or ordinary) value (the second cheapest quintile). He explained that the spread of valuation across markets is critical to achieving outperformance. He also said that he believes today “deep value is generationally cheap”

Inker showed that the most expensive stocks were in their 88th percentile of value and the cheapest were in their 3rd. This means they are almost as dear and cheap as they have ever been, with deep value stocks cheaper than they were in the dot com boom. Excluding financials only takes deep value up to its 5th percentile. So this is not simply about cheap banks!

Interestingly, ordinary or shallow value (the second cheapest group) was in its 66th percentile, making it more expensive than normal. So if you’re looking for “generational” value, you need to go really cheap.

Inker emphasised that this was not a US phenomenon. Even if you exclude financials, and in every region globally, deep value is at a 1 in 20 year low.

Surprisingly, the most expensive stocks are even dearer outside the US. The cheapest stocks are almost as cheap and are still at extremely cheap levels. Regular or shallow value is cheaper globally than in the US. Note that the top 3 quintiles are all much more expensive than is normal, both internationally and in the US.”

Text Source: Behind the Balance Sheet Substack

Image Source: Ben Inker, GMO’s strategist, titled “Value Investing isn’t What you Think it is”.

The successful contrarian has to:

- Observe the playing field and understand what expectations are priced in;

- Develop a variant perception when price diverges substantially from value;

- Have the courage to diverge from herd (miss out on near-term opportunities, possibly shut down lines of business);

- Create conditions that allow her to diverge from the herd (sufficient cash flow, liquidity reserves);

- Act during a limited window of opportunity; be able to source deals, raise capital under adverse conditions, and turn around underperforming assets.

Source: https://neckar.substack.com/p/the-courage-to-stand-out-sam-zells