Nothing discussed/written should be considered as investment advice. Please do your own research or speak to a financial advisor before putting a dime of your money into these crazy markets. In other words, if you buy something I bought, you deserve to lose your money.

The only reason why I am making my portfolio public because it provides accountability to me. Some or all the analysis I provide could be from the top of my head and should not be considered accurate.

My investing goal is simple; to try to manage risk while being fully invested without market timing. Howard Marks said it best, “even though we can’t predict, we can prepare.”

All my references to the Market are only for the US Market.

Performance

In Q1 my stock portfolio was down 2.76% compared to a negative 4.63% for the S&P 500.

“At certain speculative junctures, prudence itself becomes unprofitable, and this juncture – say, the five or six years starting in approximately 2015 – has been the showcase of that paradox. Reaching for yield and chasing after performance were once what a conscientious fiduciary would never stoop to do. In the age of ZIRP (and the full heat of indexation), those offenses against good practice became almost compulsory.” ~The Nov. 26 edition of Grant’s Interest Rate Observer

Portfolio Activity

In Q1 my stock portfolio was down 2.76% compared to a negative 4.63% for the S&P 500.

There was much more activity in my account that I anticipated. At the start of the year I sold ZIG because the fund no longer had a short book; I wanted to tax loss harvest losses so I sold GLRE. On the day Russia invaded Ukraine I sold out of all my UK and Russian exposure. I also punched out of Schmitt Industries.

(Quick aside to Russia and its war with Ukraine. I read everything I could about what was happening at the border of Ukraine. I concluded Russia was posturing and there was a small percentage a shot would be fired. Obviously that was wrong. When Russia invaded Ukraine I immediately sold all my Gazprom and Russia ETF shares. It wasn’t difficult to sell; rather, I was extremely annoyed that my 100% return became a 10% return. The learning I took from this experience is I immediately acted when my thesis changed; I didn’t hesitate. I think two years ago I wouldn’t have sold and waited it out. Lastly, the Russian assets are incredibly cheap but I no longer wanted to profit from the war.)

I made new positions to Intel, Crescent Point Energy, ConocoPhillips, EOG Resources, Prosus, Citigroup, British American Tobacco, Petroleo Brasileiro and a basket of international and emerging market ETFs. I added to my existing positions in Schwab, Aimia and PLx Pharma.

Company Commentary

Intel

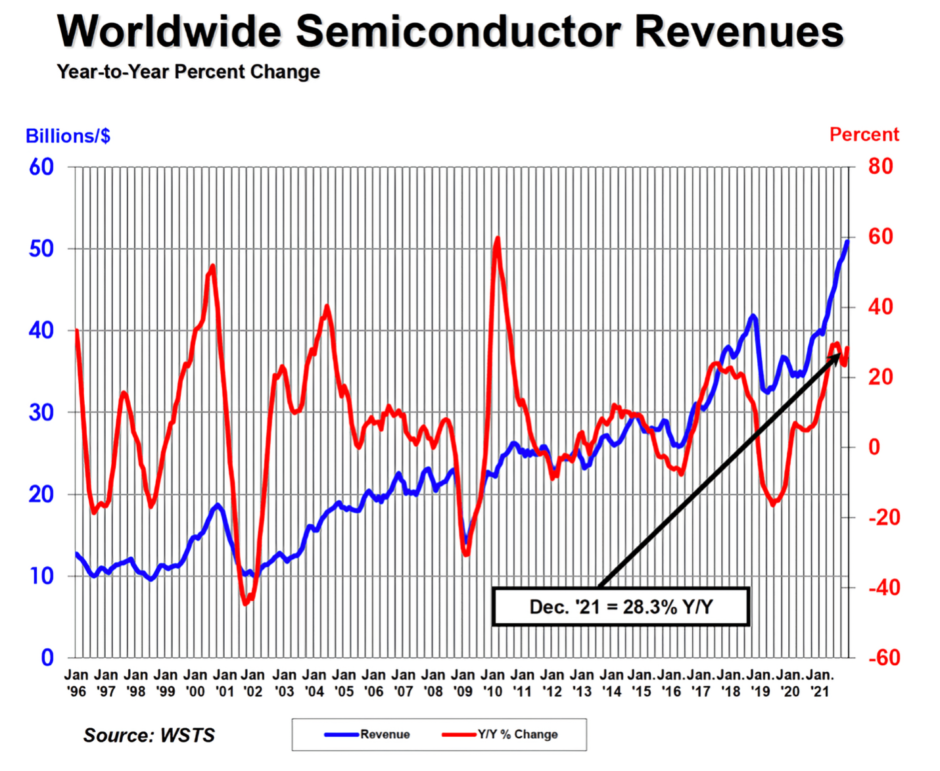

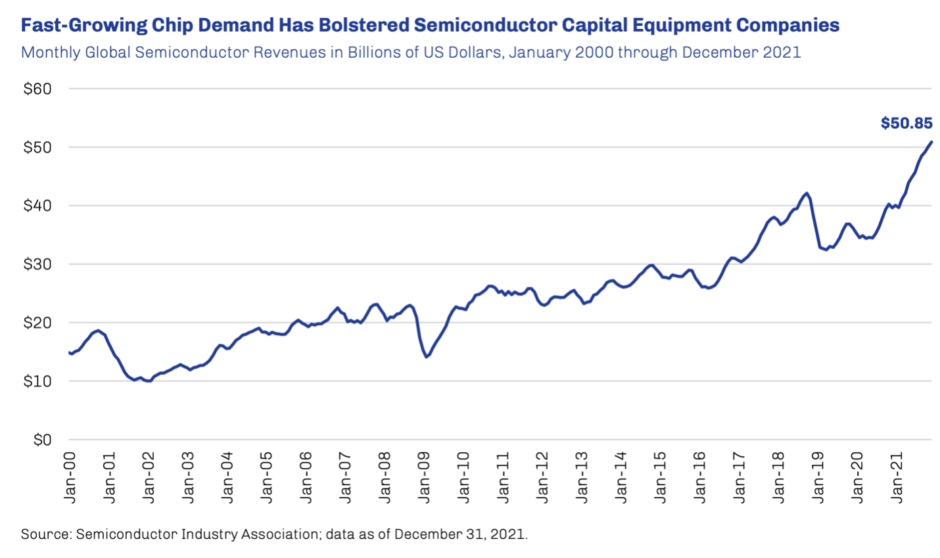

My thesis for Intel is the company is they are essentially a defense company and Intel’s industry has tremendous headwinds (two images below) in the long term.

Global sales, for the industry, in December 2021 were $50.9 billion, an increase of 28.3% compared to the December 2020 total and 1.5% more than the total from November 2021. Fourth-quarter sales of $152.6 billion were 28.3% more than the total from the fourth quarter of 2020 and 4.9% higher than the total from third quarter of 2021.

The industry had a violent cyclical nature in the 1980s and 1990s but now there are fewer players and the players that exist are better capitalized. Also, chip demand today is being driven by the need for innovation because competition for the end users (i.e. the companies that are receiving the chips) is much greater.

Semiconductors is one of the most important hard assets in the world because the hardware is used in everything we do. In my opinion, for national security reasons the United States is not going to allow Intel to fail. The government will give them tax breaks and subsidies to ensure Americans can control supply of semiconductors. Recently the Senate voted 68-28 for the plan, which includes $52 billion in grants and incentives to bolster chip manufacturing as well as provisions aiming to jump-start innovation and bring key industries back to the U.S. amid a global supply chain crunch.

The biggest headwind for Intel is its going to take a few years for their strategy to become a reality but with so many tailwinds behind Intel I see a heads I win and if tails I don’t lose very much.

Energy

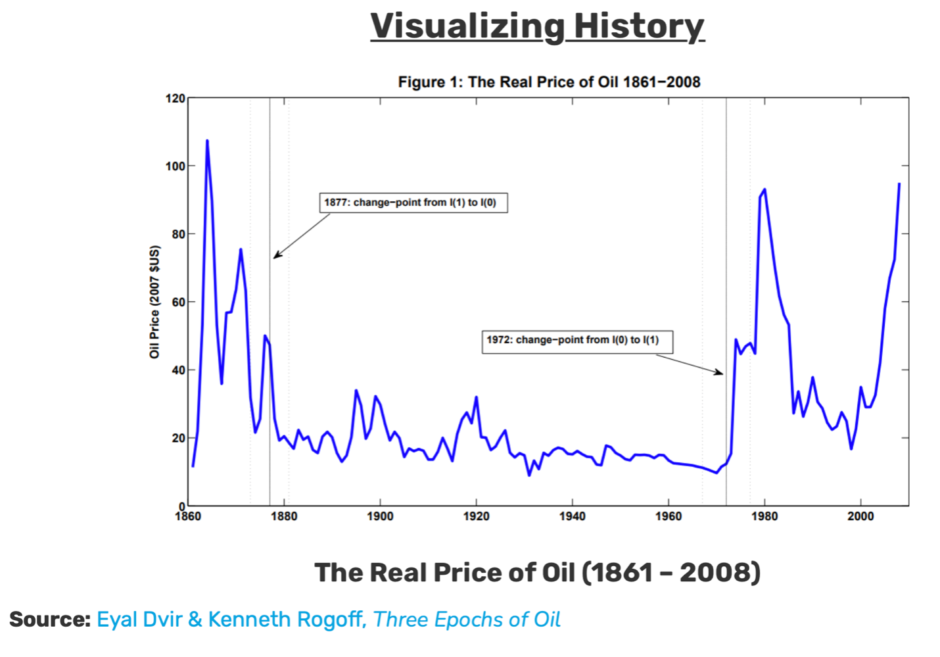

When oil was $120 a barrel I sold 15% of my Exxon and Chevron stock. My rationale at the time was oil companies and prices are cyclical and I thought we were getting somewhat close to the point where demand would decrease (image below) because in the past when America had an oil shock (the oil embargo of 1973, 1979, 1989-90) demand decreased.

The energy companies I added occurred after my sale of Exxon and Chevron in late March when oil was at $110 a barrel because I no longer believed demand would decrease. In fact local governments and foreign governments are thinking of providing subsidies and removing taxes on oil.

For example, with Maryland, Connecticut and Georgia are among the states temporarily cutting their gasoline taxes and Ohio, West Virginia and New York weighing similar measures along with state governors advocating for gas stimulus checks its only a matter of time these policies become mainstream especially in Democrat led states.

In other words, if the government is going to prop-up/sustain demand then oil can increase significantly. Also, this phenomenon is happening throughout the world. Germany has reduced its taxes on oil. Quebec is giving everyone $500 (right before an election). All these policies are going to sustain oil demand.

I have no idea what will happen to Russian oil. Its very possible that most or some of that oil doesn’t end up in the world economy because refiners do not want to take it for fear of bad PR. If the war ended today I still don’t think Russian oil comes back to the world economy instantly; I think it would require a regime change and months of assurances that Russia won’t attack anyone any time soon.

American producers, especially the public traded ones, aren’t going to produce a lot more oil in the future. And its very possible OPEC doesn’t have enough reserves to increase the amount of oil too. Maybe we get a little more oil from Venezuela? Canada won’t increase production because their prime minister made a deal that allows his party to keep its anti-oil policies in place until 2025. In sum, there won’t be any meaningful supply added to the world economy for at least 12 months and maybe more. If the price of oil dips I will add to my oil exposure.

A headwind for the American energy companies is if President Biden invokes an export ban on oil and natural gas. I think an export is highly unlikely but since this is an election year it’s possible the Biden uses his powers and doesn’t allow America’s oil and natural gas to be sent to Europe.

Prosus

The Dutch-listed technology investor Prosus NV—a subsidiary of the South African tech giant Naspers —owns 28.9% of Tencent. It was 30% but Prosus sold 2% of its shares for $14.7 billion in April. In its September 2021 filing, management has said they will not sell any Tencent stock for three years.

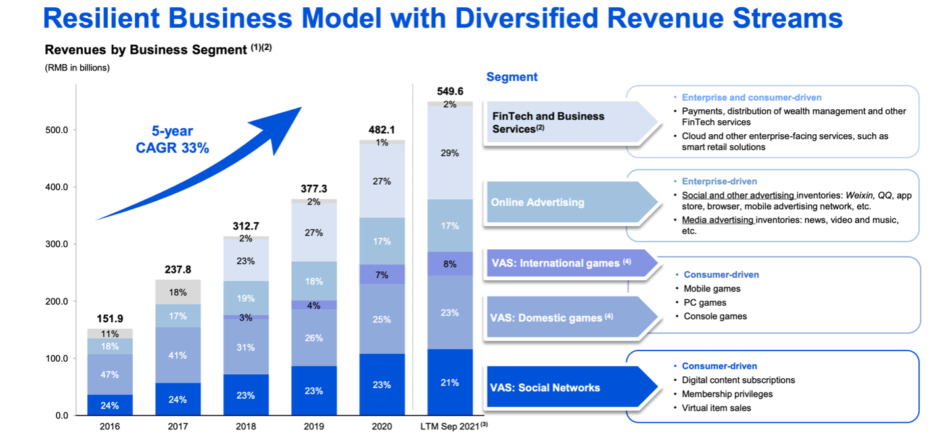

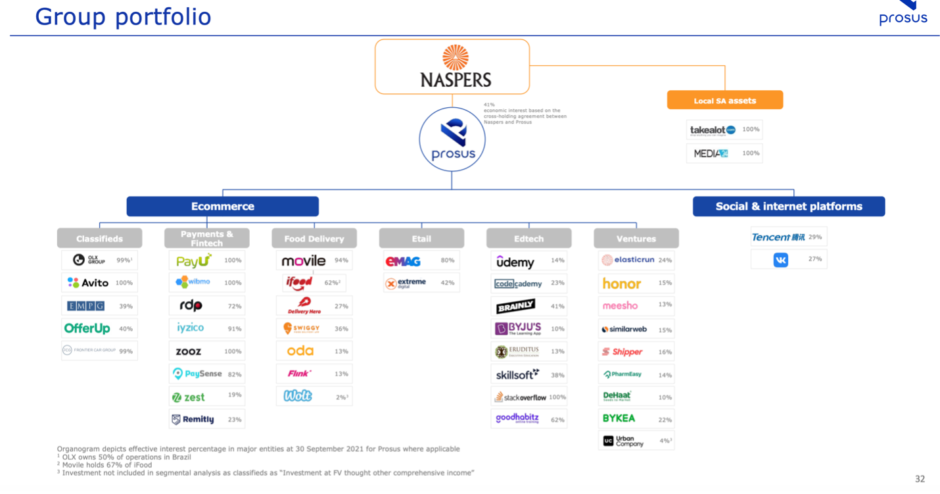

I made 3.25% position in Prosus because I wanted exposure to one of the best companies in China (image below). If this company was domiciled in America instead of China it could possibly have the largest market cap.

Prosus owns about $140 billion of Tencent stock, plus another $10 billion of cash and shares of Delivery Hero, a food delivery company, plus a collection of private-company investments marked at a valuation well over $30 billion (image below). Prosus’ market cap is $113 billion so I’m getting Tencent at a 20% discount and I get all the other companies for free.

The latest quarter was not very good for Tencent. “The October-to-December period rose 7.9% to 144.19 billion yuan, equivalent to $22.65 billion. That missed expectations of analysts polled by FactSet and marked the company’s worst top-line growth since it went public in 2004.”

This comes after a myriad of regulations from the Chinese government. The first was a halt of new game approvals. Then it was the government’s broader, more recent crackdown on a range of subjects, including youth gaming activity, online lending, after-school tutoring and the use of personal information. It is possible their economy is too heavily reliant on housing and as we saw in America what happens when there is an inflated housing bubble. Lastly, its also very possible Tencent’s accounting is fraudulent.

All that said, you don’t have the opportunity to buy the stock at its current price unless there are headwinds. My thesis is either this investment is a zero or I get tremendous compounder. To be honest I originally sized the position to be 5% but I had to reduce my exposure because China-specific headwinds. However, Tencent’s core gaming, advertising, fintech and cloud software franchises are some of the world’s best and its trading at 16 times earnings. I’m okay with losing 3.25% of my money on this bet.

Schwab

This is a company I wish bought more of when it was cheap. When I made my initial investment in April 2020 my thesis was Schwab was a call option on rates eventually increasing that came with a 2% dividend. Since my initial investment I never added to it until this quarter. The reason why I never added to my position was I had no idea Schwab was an exceptional business. They’ve been growing brokerage accounts 5-7% per year for many years and the growth rate has been increasing. They now have their own robo-advisors and expanded their RIA penetration with the acquisition of TD Ameritrade.

Schwab earns most of its profit on the spread on interest rates via the cash deposits held in brokerage and bank accounts of its customers. They approximately have $7.5 trillion in assets. It currently has a market cap of $168 billion, which is pretty cheap if interest rates increase meaningfully. If the Federal Reserve panics after a couple of rate increases like in 2018 and rates come back down then Schwab is expensive in the short term, but if they continually grow the busines will still grow in single low-to-mid single digits.

Aimia

In early February it was announced Aimia would divest its stake in the PLM Loyalty Program with Aeromexico for $517 million. The company has a current market cap of $476 million. Since the announcement the stock is down 6.4%. On their latest earnings release the CEO said, “We also intend to allocate up to $75 million of the net proceeds towards a combination of

opportunistic share buybacks and/or a special dividend to common shareholders.” In other words they may buy back 10% of the shares outstanding.

Aimia has been restricted to buy back its shares because of its current Normal Course Issuer Bid (NCIB). However, they filed a new NCIB and in mid-June they’ll be authorized to buy back its shares.

Is there something I’m missing? I feel like this is a one foot hurdle?

Market Commentary

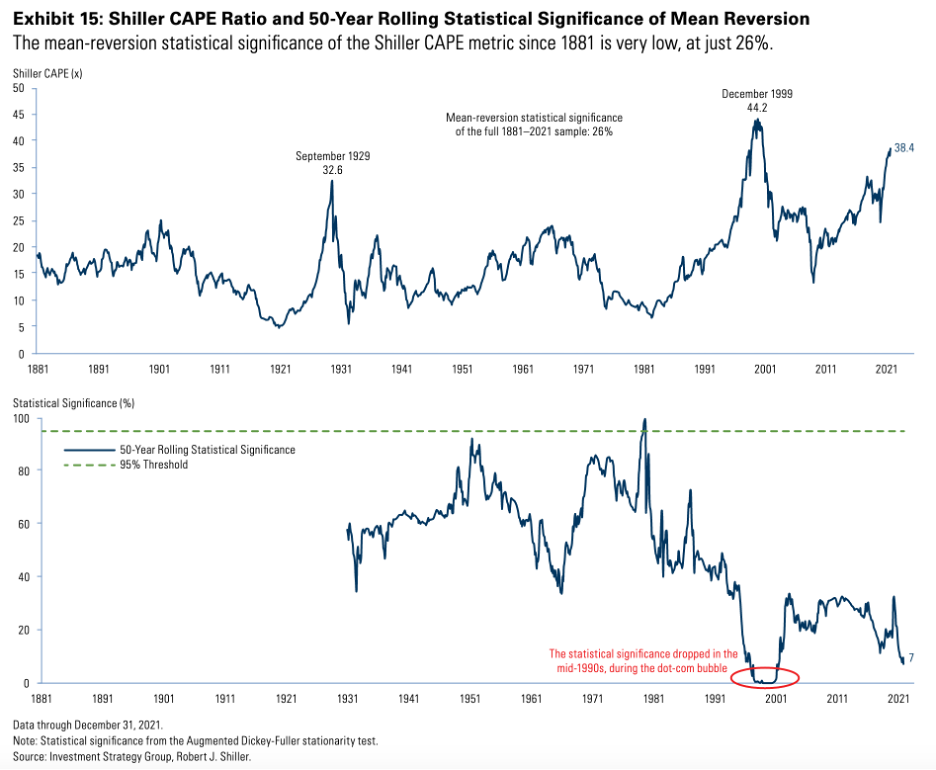

Global inflows into equities have surpassed $1 trillion in 2021, exceeding the combined total from the past 19 years (source: Holger Zschaepitz). The Shiller Cape, at the end of March, is 36, which is really historically. After reading these two metrics its easy to conclude the Market is in a bubble. However, how predictive is the Shiller Cape? The image below is from the 2022 Outlook from Goldman Sachs. The document was released in January.

“The statistical significance over the full sample is 26%. This means that there is only 26% confidence that the Shiller CAPE is mean-reverting, and 74% confidence that it is not. The traditional threshold to consider a relationship statistically significant is 95%. We want to emphasize that valuations alone are not sufficient measures for underweighting equities. High valuations do not reach some magical target and then revert to some stable mean; furthermore, the time period for valuations to reach some long-term average is highly variable and therefore uncertain.”

Another quote from the paper. “There have been 15 Federal Reserve tightening cycles in the post-WWII period. Contrary to received wisdom, not all tightening cycles have led to a recession. Only nine, or 60%, of the cycles did so. Of the last four cycles, only one resulted in a recession: the tightening cycle between June 2004 and September 2006.”

I highly suggest reading it. Its one of the rare papers where I read the entire document; its that good.

I have no idea what’s going to happen with the American economy. I think there are three scenarios:

- Inflation comes down towards the end of the year but it stays in the 4-6% range for the next 1-4 years. Despite the inflation Americans continue to spend.

- We get a gnarly recession that becomes stagflation.

- We get a deflationary bust due to the massive amount of debt.

I think Europe is getting #2 and America will get a mix between #1 and #2. However, I’m not confident in my prediction which is why I’m still mostly invested. Other than my 401k I’m not adding new money to equities and I’m holding cash.

Like most people I’m risk averse and the fact I’ve read a lot of financial history and the boom and bust cycles that occurred regularly only enhances my risk aversion.

At the end of 2021 I read The Great Depression: A Diary by Benjamin Roth and the two biggest takeaways I took was A) make sure you have enough money to survive the downturn and B) the people who did survive didn’t participate in the financial mania.

It’s very possible the Market compounds at 7-plus percent per year for the next couple of years but having the cash makes it extremely easy for me to sleep at night.

The table below is a breakdown of my portfolio at the end of Q1. What you see below where my entire net worth, excluding my home, is allocated. Lastly, my 401k is 100% invested in a Small Cap Value Fund.

| Company | % |

| BRK.B | 12.1% |

| MU | 9.5% |

| BAC | 4.8% |

| MKL | 4.6% |

| PLXP | 3.9% |

| SCHW | 3.7% |

| MO | 3.5% |

| AIMFF | 3.5% |

| MMP | 3.2% |

| EPD | 2.5% |

| NEM | 2.0% |

| HII | 1.8% |

| GD | 1.7% |

| NOC | 1.7% |

| PROSY | 1.4% |

| GVAL | 1.3% |

| LMT | 1.2% |

| C | 1.2% |

| INTC | 1.2% |

| KGC | 1.1% |

| XOM | 1.1% |

| EQC | 1.0% |

| CVX | 0.9% |

| PREKF | 0.7% |

| BHF | 0.6% |

| DFIV | 0.5% |

| AVDV | 0.5% |

| AVES | 0.5% |

| AVIV | 0.5% |

| AVDE | 0.5% |

| BTI | 0.2% |

| EOG | 0.2% |

| COP | 0.2% |

| PBR | 0.2% |

| CPG | 0.2% |

| LAND | 0.1% |

| FPI | 0.0% |

| Gold (Physical) | 2.9% |

| Platinum (Physical) | 0.7% |

| Farmland | 3.7% |

| I Bonds | 6.1% |

| Cash | 7.8% |

| 401k | 5.2% |

Below is a breakdown by category:

| Category | % |

| Bonds | 6.1% |

| Cash | 7.8% |

| Conglomerate | 12.1% |

| Defense | 6.4% |

| Financials | 10.3% |

| Insurance | 4.6% |

| International | 3.8% |

| Manager | 3.5% |

| Oil/Gas | 9.0% |

| Other | 5.1% |

| Pharma | 3.9% |

| Precious Metals | 6.8% |

| Real Estate | 4.7% |

| Semiconductor | 10.7% |

| Small Value | 5.2% |