Nothing discussed/written should be considered as investment advice. Please do your own research or speak to a financial advisor before putting a dime of your money into these crazy markets. In other words, if you buy something I bought, you deserve to lose your money.

Even though no one will read this I am making my portfolio public because it provides accountability. Some or all the analysis I provide could be from the top of my head and should not be considered 100% accurate.

For the first quarter I’m up 17.9% while SPY, a S&P 500 index fund, is up 5.9%. I honestly don’t care what my performance is quarter to quarter because there is nothing intelligent that one can say about short periods like three months.

All my references to the Market are only for the US Market.

My goal is simple; to try to manage risk while being fully invested without market timing. Howard Marks said it best, “even though we can’t predict, we should prepare.”

Where We Are Now

I have no idea what the Market will do in the future. All I can do is try to understand where we are. This is where I think we are:

- The Market is expensive. The S&P 500 is trading at 20 times forward earnings which is the 90th percentile of its valuation for the past 30 years.

- A lot of forward returns have been pulled forward to today, which means future returns will probably be low; a Bank of America analyst thinks the S&P 500 will only return two percent per year the next ten years; if you add two percent in dividends that’s only four percent per year.

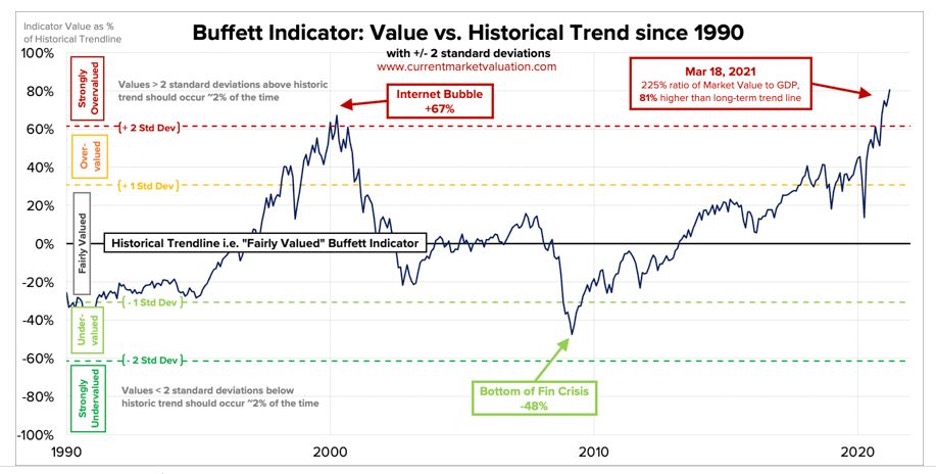

- The Market is in a bubble (image below and links to other images here and here) but there are still of areas of the Market that are still cheap. More on this in the next paragraph.

- Interest rates are extremely low but I do not believe interest rates is the reason why the Market is expensive. For example, in 1999 the 10 year treasury was yielding 5-6% and the Market got even more insanely priced.

There is a bubble in SPACs, revenue losing companies, NFTs, meme stocks, penny stocks and some parts of the tech sector. However, I do not believe the Market as a whole is in a bubble. For example, Newmont is selling at 13.5 forward P/E; Bank of America at 14 forward P/E; Berkshire Hathaway is trading at 1.3 times book value. All these companies are selling at reasonable prices. If the Market was in a bubble these companies wouldn’t be this cheap.

Positioning for 2021

I’m fully invested. Most of my portfolio is in value, which accomplishes two things.

- Value is very cheap. Buying companies at reasonable prices protects me on the downside in a bear market and provides more upside in a bull market.

- Value will benefit from inflation. I came into 2021 thinking heavily about inflation and I attempted to position my portfolio to do well in an inflationary environment. I discuss more about inflation in the next section.

There are many scenarios that could happen to the Market. One is the Market is basically sideways for the next 1-30 months. In sideways Markets you want to own dividend paying stocks. John Bogle calculated that during the 81 years to 2007, reinvested dividend income accounted for approximately 95% of the compound long-term return earned by the companies in the S&P 500.

Another scenario is the Market continues to go up like it did in the late 1990s. Very smart people were saying in 1996 we were in a bubble and it took four years for the bubble to pop.

I do not believe we are in a bubble but if I did believe we were in a bubble I would not want to hold cash because:

- I have no idea how long this bull market will last

- With all the money printing I don’t want my cash to be inflated away

- I do not have the mental fortitude to be in cash for a year or more

Quick hypothetical: If my portfolio had a million dollars I would only be 50% invested. I say that because when the bull market ends, it’s going to end badly and I would want to have cash ready to deploy.

Inflation

I have no idea if we’ll get a spike in inflation this year or next year. There are many possible scenarios for inflation and deflation to occur.

One scenario is we get inflation but in a way that isn’t measured by the Federal Reserve. For example, their inflation gauge/metric they use does not include the price of home real estate, college education and health care. I think most Americans have experienced one form of this inflation. But since the Fed Reserve does not incorporate those metrics, they can continue to lie to the American people and say inflation has been below three percent the past ten years.

Another scenario is we get inflation for a few months then we go back to deflation. The Federal Reserve said it’s going to keep short term rates at 0% until 2023. Japan during the last ten years have shown that low interest rates creates deflation. When retirees have no yield on their savings they have to save more and therefore, spend less.

A third scenario is we get stagflation. This scenario would be extremely bad for society if this occurred. If this occurs, it will take several years for this to happen.

A fourth scenario is we continue to have inflation be under two percent.

I have hard time believing we do not get inflation when A) governments in the developed world, except China, are printing a lot of money and devaluing their currency and B) government’s (America, UK and Europe) are providing credit guarantees to the commercial banking system. In the last 10-11 years banks didn’t make loans due to regulatory constraints. In other words, new money is going to be pumped into the economy via loans from banks.

It’s very possible why America has had low inflation the past the ten years is because all the money that was printed went into equities and asset prices and the money stayed out of the economy. The profits for the S&P 500 peaked in 2016. What has caused the Market to increase so much since 2016 is multiple expansion (investors paying more each dollar in profit). But now, with banks pumping money into the economy I think the odds of meaningful inflation have increased.

The future is unknowable. The best I can do is construct a portfolio that can do well in a variety of environments. If inflation doesn’t occur I should do well because of mean reversion; or in other words, the companies I bought at low prices will positively revert. If we get inflation my exposure to gold, precious metals, miners, oil, pipelines, farmland and real estate should do extremely well.

Quick aside: The most maddening part of all the money printing in America is it probably means we will no longer be the world’s reserve currency in about 10-15 years (to China), which means the people who bear the brunt of all the negative consequences are the kids under the age of 10. It saddens me that something like 65-70% of the elected officials in the three branches of government are over the age of 65. That means when the negative consequences occur A) they will all probably be dead and B) a lot of them are so rich already that their heirs will live comfortably.

Gold

Here are three facts about gold (source):

- Gold and the Dow were both 800 in 1980. Today Gold is $1,700/ounce. The Dow is near 32k

- Over the last twenty years, Gold is up 340%. Stocks are up 208%, with dividends

- Since 1980, Gold is up 153%. Inflation is up 230%

About five percent of my portfolio is in physical gold. I own gold because I want an asset that is not part of the government’s monopolistic financial system. That rationale makes me sound like someone who has a bunker in his backyard but it is clearly obvious governments are devaluing their currencies so I want a hedge my exposure.

In 2012 government mandated, with the blessing of the Supreme Court, that all Americans have to pay for health insurance and if someone doesn’t you have to pay a tax. Never think the government has a limit on what they will make us do financially.

The table below is a breakdown of my portfolio on March 31, 2021 after the close.

| Company | % |

| MU | 15.3% |

| BRK.B | 11.2% |

| MKL | 7.3% |

| BAC | 6.3% |

| PLXP | 5.3% |

| MO | 4.3% |

| MMP | 3.5% |

| SCHW | 3.4% |

| AIMFF | 2.7% |

| GLRE | 2.5% |

| HII | 2.4% |

| EPD | 2.3% |

| EQC | 2.1% |

| ZIG | 1.9% |

| NEM | 1.8% |

| GD | 1.6% |

| KGC | 1.5% |

| NOC | 1.5% |

| OGZPY | 1.3% |

| LMT | 1.1% |

| XOM | 1.0% |

| BHF | 1.0% |

| FRFHF | 0.9% |

| CVX | 0.8% |

| DTLA | 0.7% |

| RTX | 0.4% |

| FFXXF | 0.3% |

| FPI | 0.0% |

| LAND | 0.0% |

| SMIT | 0.0% |

| ECH | 0.5% |

| ENOR | 0.0% |

| EPOL | 0.4% |

| ERUS | 1.4% |

| EWP | 0.0% |

| EWS | 0.5% |

| TUR | 0.4% |

| EWI | 0.0% |

| EWUS | 0.1% |

| GVAL | 2.4% |

| FNDC | 0.5% |

| EWY | 1.3% |

| FNDE | 0.0% |

| AVDV | 0.0% |

| ICOL | 0.3% |

| Gold (Physical) | 3.2% |

| Platinum (Physical) | 1.0% |

| Farmland | 3.5% |

Below is a breakdown by category:

| Row Labels | Sum of % |

| Conglomerate | 11.2% |

| Defense | 7.0% |

| Financials | 10.6% |

| Insurance | 8.2% |

| International | 8.2% |

| Manager | 7.1% |

| Oil | 8.9% |

| Other | 4.3% |

| Pharma | 5.3% |

| Precious Metals | 7.6% |

| Real Estate | 6.4% |

| Semiconductor | 15.3% |

| Grand Total | 100.0% |

Quick note: “Manager” is defined as I invested because of the person/people running the company/fud.

Portfolio Additions/Commentary:

PLx Pharma ($PLXP)- Thomas Phelps, in his book, 100 to 1 in the Stock Market said, “find new products that improve lives.” I believe PLx Pharma is one those products. Simply put, there has been no innovation for aspirin in 70-80 years. PLx Pharma recently had their second version of aspirin (VAZALORE) approved by the FDA.

They have two versions of VAZALORE; a 325mg and a 81mg version. The 325mg has been approved but there was a 2.5-year delay in the approval of the 81mg because of manufacturing issues.

VAZALORE is the first FDA approved liquid-filled aspirin capsule. VAZALORE is better for blood clotting and its better absorbed in the GI tract, which significantly reduces the risk of stomach erosion and ulcers. This is achieved by the unique delivery system of the capsule.

My brother has a PhD in organic chemistry and he backed up the science of the pill. I also provided information about VAZALORE to two actively practicing doctors (in different geographic locations) and they both thought VAZALORE could scale well.

Most importantly, the company has 58 patents across various countries (USA, China, Japan, Mexico, South Korea) that extends into 2032. Also, they have pending patents in Europe, Canada and India; if they’re accepted the patents will be valid through 2032.

In early March it was announced the 81mg was approved by the FDA. They are currently ramping up production and begin selling it to hospitals in the third quarter.

Overall, the board of directors owns about 10% of the stock. Half of the CEOs and the Executive Chairman’s stock options have an exercise price of $12.50 by 2025 so they are incentivized to do well. Also, members of the board and upper management have been buying the stock the past 6-12 months.

The total addressable market for aspirin in the USA is $9-11 billion. If they get 10% of the market they could have $1 billion in revenues which means they could have a market cap of $5-10 billion. When I started buying the market cap was about $175 million so we’re looking at a possible 400-500% return with room for a lot more.

Lastly, the delivery system of VAZALORE could also be used for ibuprofen (aspirin and ibuprofen can be used to treat the same pains but they are different drugs). The company is currently in one Phase 1 trials with the FDA.

Magellan Midstream Partners ($MMP)- I believe Magellan will provide a safe ten percent dividend. They will have minimal maintenance capital expenditures. I think America isn’t going to be building any new pipelines in the near future and possibly for my lifetime. Since no new capital will come into this industry, Magellan has a strong moat. Oil will continue to be used in meaningful way for at least another 20-30 years. The capital allocation of the management is good. They paid off 2020 debt which had a four percent yield by taking out a loan that’s due in 2024 at a three percent yield; they have no debt for the next four years. I bought the stock at around $40 so after four years I will have received $20 in dividends. As of today, I think the stock is worth about $80.

Altria ($MO)- I don’t care about the negative effects Altria’s products have on their customers. What’s difference between cigarettes and alcohol? I would argue alcohol has had a bigger negative impact on society than cigarettes. How about Coca Cola? McDonalds? All these companies produce products that slowly kill their customers too. Why do only cigarettes get the bad rap? When I bought Altria it was extremely cheap with a 10% earnings yield. Also, the company has pricing power that will do well inflationary periods.

Altria is an incredibly resilient company. If you look at their revenues even though consumption has decreased revenues have continued to grow. The government makes a ton of money from Altria via taxes, so the government is incentivized to leave Altria alone. Also, it is virtually impossible for a new company to come in because cigarette companies are not allowed to advertise which further entrenches Altria’s moat. Also, Altria owns a big share of Cronos, the Canadian cannabis company. If the Democrats legalize weed Altria will be able to utilize their distribution system to take a share from these smaller companies.

Equity Commonwealth ($EQC)- this is a bet on Sam Zell. I bought the stock at about $27. The company has no debt and has $24 dollars in cash. So basically, I’m getting about 85-87% of the cash and with all that cash I have Mr. Zell and his team allocating it. I think Mr. Zell and his team are better capital allocators than me. This is a heads I win a lot and a tails I don’t lose very much.

Greenlight Capital Re, Ltd. ($GLRE)- this is a bet on David Einhorn. He was probably one of the best investors in America in the 2000s but in the 2010s he has been very below average. I’ve read his book and his letters. I think he’s a better capital allocator and stock picker than me. Also, his stock portfolio will do very well in an inflationary period and most importantly, there are shorts, which means if the Market does have a big drawdown the portfolio will benefit. My buy price was about $7.75 which is about 58% of book value.

The Acquirers Fund ($ZIG)- like Greenlight Capital I am betting on A) the person running the portfolio (Tobias Carlisle), B) the portfolio is long Value and has shorts and C) the price point being cheap enough there isn’t that much downside. I’ve read all his books and I believe he’s a better capital allocator and stock picker than me. (Can you see a trend here?)

Like Greenlight, The Acquirers Fund is a long-short portfolio. I like the long-short portfolio because if there is severe downside to this Market the shorts will lessen the drawdown. Also, since bonds less than inflation the best thing to hedge downside risk is with a long-short portfolio.

I’m not a fan of the high fees of the fund but the asset is cheap I expect the fund to outperform a low cost index fund. For example, the table below shows the one year performance of the fund versus a low cost S&P 500 index fund.

The obvious flaw with my numbers is I assume both would reach their intrinsic value in one year but I wanted to quickly show my thinking.

Defense Companies

I bought a basket of Defense companies ($HII, $GD, $NOC, $LMT and $RTX) as a hedge against the world remaining peaceful and because they’re pretty cheap. In general, defense budgets remain high no matter which political party is in power.

I understand the logic of keeping these companies funded. If you keep your car in your garage for a year and you don’t use it. When you go to start it up its not going to run that smoothly. The same applies to defense companies. You don’t want these companies to fire a lot of people and then suddenly have to hire people back quickly.

Huntington Ingalls Industries is a duopoly and will probably grow 11-12% per year. It pays 2-3% dividend and their CEO is one of the largest shareholders (about $100 million worth of stock). Lockheed Martin has a $100 billion enterprise value and generates $5 billion in free cash flow, is trading at 13 times PE with a 3-4% dividend, which was raised. They just hired 10,000-11,000 people and they bought back $1 billion worth of stock.

Special Mention

Micron ($MU)- I’ve owned this stock for about two years and I have a 105% return. I realized I haven’t written about this company yet.

I have not sold any shares. I’m not going to lie and say it has been easy not to sell. The reason why I haven’t sold is the saying that, “you never got poor by taking profits, but you also didn’t get rich by selling.”

When I first made this investment it was pretty easy to make. First, the CEO is quite good with a proven track record. (Also, he’s an immigrant to America and I prefer CEOs who are immigrants because they appreciate the opportunity of the American Dream. In other words, I stated one of my biases.)

Second, in terms of evaluation I knew it was a cyclical and did a simple average Owners Earnings calculation and Micron was very cheap. Micron’s average ROE and ROIC from 2011-20 was 15.5% and 13.7% respectively.

The longer I’ve been a shareholder the more I realized Micron may have tremendous growth potential, which is being overlooked by the Market. Micron is in an oligopoly business and with AI becoming a bigger part of society I realized there will be a lot more DRAM needed. Some see Micron as a commodity business but the world is going to need a lot more of that commodity. Even at a $88 price point the forward PE of the stock is about 13-14, which means it’s still cheap.

Management did a lot of good things in 2020. For example, Micron (and Lockheed Martin) paid their suppliers early so the suppliers could keep making the components. A cynic would say Micron was paying early for their own benefit, which is could be true, but they easily could have behaved like Walmart and screwed their suppliers.

I recently read 100 Baggers and 100 to 1 in the Stock Market. They’re both fantastic and are must reads. Also Bill Gurly on the Entrepreneurs and Technology Podcast said, in regards to holding a stock, “the hardest thing to possibly do is just close your eyes and forget it. And the only thing analysis that’s going to cause you to do is sell the stock. You know, you — you’re not going to run analysis, you know, for the fourteenth time and go, hmmm, I should keep holding like that. And that is so hard, so, so hard to implement — easy to say, very hard to implement.”

I’ve been thinking a lot about elongating my hold periods. The data in the two books show that in order to get a 100 bagger you need to hold for a long time; usually at least 10 years. So, in order to get those gains you have to have the fortitude to sit on your hands during high/low interest rate periods, recessions/depressions and unforeseen macroeconomic events.

Currently, I’m up 105% on Micron, which at the time was, on a cost basis, 10-11% of my portfolio. Micron is 15% of my portfolio. It’s been extremely tempting to trim the position, but I’m not touching it any time soon.

Conclusion

I’m fully invested. Moving forward I’m going to hold more cash and physical precious metals because in the next 2-6 years I think there is a 50-65% chance we get a bad recession or even a depression and I want to have ample liquidity to ride it out. In other words, I am moving forward but with caution. I believe its important to first hedge against both the left tail before trying to go after the right tail.