I’ve noticed on Twitter that some people/investors have been posting the companies in their portfolios. Initially I thought about posting my portfolio (my IRAs and Personal Account) but I quickly decided against it. There were many reasons why.

First, I am nowhere near where I think I should be knowledge wise. I’m still a complete noobie. (It goes without saying anything whatever I say/write is not financial advice…and if you buy something I bought you deserve to lose your money.) What use will anyone get out seeing what a noobie owns?

Second, if (when) I make a mistake it will be available for the whole world to see. No one is going to read this but since Google’s data centers are so large whenever I click “publish” this post will be indexed for the rest of time.

After much thought I decided to post my portfolio because it gives me accountability. If I make a mistake having this document makes me accountable to myself and (hopefully) forces me to do better.

The table below is a breakdown of my portfolio on June 30.

| Company | % |

| BRK.B | 18.5% |

| MKL | 7.2% |

| XOM | 5.4% |

| JPM | 4.6% |

| MU | 4.6% |

| EWY | 4.6% |

| Gold | 4.1% |

| BAC | 3.9% |

| BA | 3.7% |

| BPY | 3.3% |

| Intl Mkts | 3.3% |

| VNQI | 3.2% |

| CSV | 2.1% |

| IWN | 2.1% |

| BHF | 1.6% |

| TAIL | 1.3% |

| SCHW | 1.2% |

| IWS | 1.0% |

| PNC | 0.8% |

| SPR | 0.8% |

| COF | 0.4% |

| HEI | 0.1% |

| Bitcoin | 0.1% |

| Cash | 22.1% |

“Intl Markets” consists of index funds in: Russia, Turkey, Poland, Colombia, Spain, Singapore, Norway, Chile and Italy. “Gold” is physical gold.

It’s possible the Market goes up 30 per cent and I also think it’s just as likely the Market drops 30 per cent. I can make an convincing argument for either scenario.

Inflation has to come in the next 1-3 years. I can’t see how exponentially increasing the money supply doesn’t create inflation. (I think it’s pretty obvious CPI is not a real gauge of inflation. At the very least it shouldn’t be relied upon as the sole gauge for inflation. I think the Chapwood Index is a better measure of inflation.) If we don’t get inflation in this environment then we never will.

If the government has another stimulus package the last thing I want to do is hold cash because the fear of having my money devalued even more outweighs buying equities in an overpriced market.

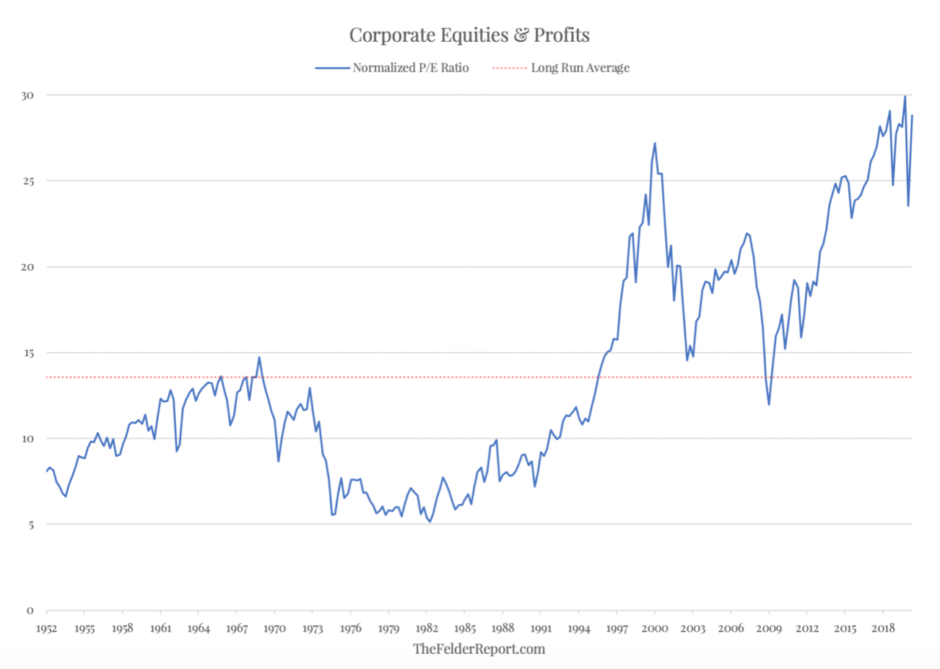

I think the Market is overvalued. The image below shows why I think its overvalued. You could make a convincing argument that with interest rates this low the Market is not that overvalued.

My biggest conundrum for the past 4-6 weeks is there a lot of quality businesses that are still really cheap. So therefore, why am I holding cash? If you told me Google was selling for half of what it’s selling for today I would instantly buy it. So why don’t I feel the same about Markel, Schwab, Carriage Services? I think these companies could be bought at a lower price.

Additionally, I’ve read recent research from Cliff Asness, Tobias Carlisle, Verdad and O’Shaughnessy Asset Management how small cap value is historically cheap. That’s the reason I bought a small stake in IWS and IWM.

The bottom line is I don’t know what’s going to happen. Perhaps small cap and midcap value start to rip and my position should have been larger. Perhaps the Market drops 30 per cent and I should have had more cash. I don’t know what’s going to happen but all I know is I’ll have the temperament to handle a drawdown.